1. The resilience-building imperative

Maritime transport underpins world economic interdependency and global supply chain linkages. Shipping and ports handle over 80 per cent of global merchandise trade by volume, and more than 70 per cent of its value. Supply chain disruptions caused by stressors spanning economic crises, political events, natural disasters, cybersecurity incidents and the COVID-19 pandemic, and more recently the conflict in the Black Sea region, underscore the role of maritime transport as an important transmission channel – one which can send shockwaves across supply chains and bring world trade and business to a halt.

Port resilience is not only an imperative for supply chains, but also for the national economies they support. Safeguarding the integrity of the maritime transport chain is a sustainable development imperative, particularly as developing countries have become major players in maritime transport and trade. Ensuring the integrity and the well-functioning of maritime transportation is critical for all economies, developed and developing alike, in particular small island developing states (SIDS) and least developed landlocked countries (LLDCs). These vulnerable economies depend heavily on maritime transport networks for their livelihood and access to the global marketplace. Furthermore, they are already burdened by disproportionately high transport costs and low shipping connectivity, which makes their trade uncompetitive, volatile, unpredictable and costly.

COVID-19 and related restrictions have caused serious disruptions in ports; risks at the port level can be multiplied across extended supply chains and across borders. Various industries faced challenges along their supply chain, which resulted in: (i) raw material shortages; (ii) lead time issues; (iii) blank sailings by ocean carriers; (iv) port closures; (v) reduced working hours; (vi) equipment shortages; (vii) labour shortages; and (viii) truck/transport capacity constraints. This situation has put pressure on the integrity of global supply chains and can could potentially erode the benefits and efforts of the past decades aimed at enhancing supply chain operations.

A paradigm shift has been unfolding since the COVID-19 pandemic, with risk management and resilience-building raising new policy and business concerns. In this context, business continuity plans (BCPs) and emergency-response mechanisms have again shown to be vital. The pandemic has underscored the need for future maritime transport to be calibrated to risk exposure and for enhanced risk management and resilience-building capabilities. Understanding exposure, vulnerabilities and potential losses is key to informing resilience-building in the sector. Industry players and policymakers are expected to increasingly focus on developing emergency-response guidelines and contingency plans to deal with future disruptions. Criteria and metrics on risk assessment and management, digitalization and harmonized disaster and emergency-response mechanisms are likely to be increasingly mainstreamed into relevant national and regional transport policies. It can be expected that early warning systems, scenario planning, improved forecasts, information-sharing, end-to-end transparency, data analytics, business continuity plans and risk management skills, will feature in policy agendas and industry plans.

Building the capability of countries to anticipate, prepare for, respond to and recover from significant multi-hazard threats is crucial, and requires enabling agile and resilient maritime transport systems. Investing in risk management and emergency response preparedness, to face future pandemics but also other disruptive events, is crucial to future proof ports and the broader maritime supply chain. The potential risk of future pandemics and other disruptive events calls for investments in risk management and emergency preparedness, such investments will future proof ports and the broader maritime supply chain.

2. Resilient ports: Key for a resilient maritime supply chain

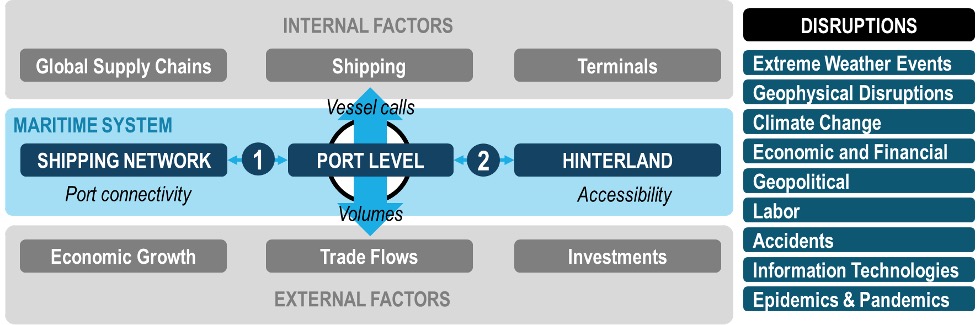

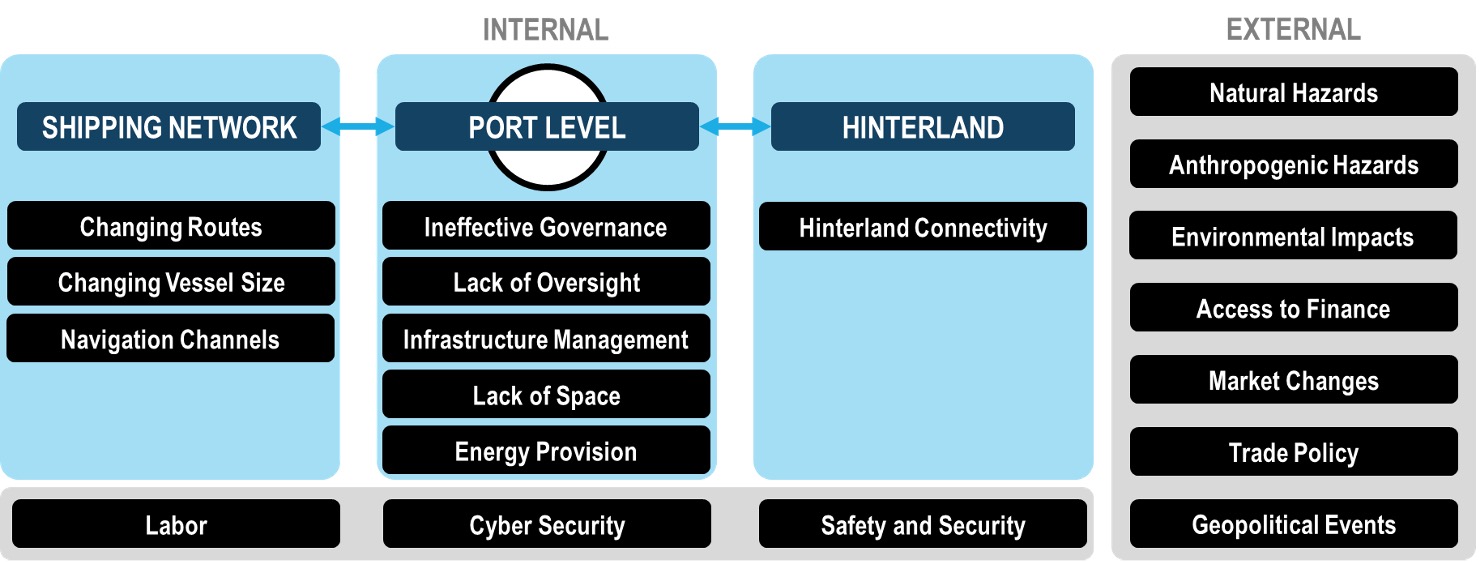

Ports are part of a continuum that includes the shipping network and their hinterland and for which they act as an interface (figure 1). Occasionally, a disruptive event (or multiple events) will occur along this landscape, which could have various causes, some predictable, some random but expected, and some unexpected. The resilience of ports and the maritime supply chains they support comprises both internal and external factors.

Figure 1: Ports in the maritime supply chain resilience landscape

Internal factors generally relate to aspects over which ports and the shipping industry have a level of control. Supporting global supply chains is internal to the port and shipping industry and is related to the configuration of shipping networks and a port’s handling capacity to support demand. The development and expansion of container terminals by port authorities and terminal operating companies also consider changes in global supply chains and related shipping networks.

External factors relate to the forces that generally affect the demand for maritime transport and therefore impact the volumes handled by shipping and port services. In general, ports and maritime shipping have little or no control over these factors, including economic growth affecting trade flows. Furthermore, agencies outside the shipping industry usually provide investments in equipment and infrastructure. Securing such funding could be contingent upon the type of risk created by the disruption(s). Some external factors can, however, be influenced, including by facilitating investment and funding. Therefore, these factors are to some extent considered as “internal”. For external factors that are more difficult to influence, it is generally recommended to establish monitoring mechanisms and scenario analysis to inform planning and preparedness action.

Disruptions can result from both internal and external factors, depending on the nature of the event. Several disruptions are specifically under the control of infrastructure managers and operators. Examples include breakage of equipment due to improper maintenance, a breach in security, or a lack of cybersecurity measures. These disruptions are within the realm of possible intervention by an actor within the shipping and port industry, and are subject to ownership structure, and regulatory oversight in the various modes of transport, equipment and infrastructure.

Several natural and anthropogenic disruptions fall outside shipping and port control. These include events, such as hurricanes, geopolitical crises, or economic recessions. Even if these elements are outside the realm of port interventions, they are drivers of change to which the port industry must adapt. The internal capability of ports to adapt to external forces is a fundamental element of their resilience.

Two port interfaces highlight the potential points of failure which could occur along a maritime transport chain:

- Ship/port interface: This relates to the interactions between ports, terminal operators and ships/shipping carriers. The actions and strategies of shipping lines can support or undermine port resilience. For instance, the decision of a shipping line to select a port or terminal as a transshipment hub impacts a port's resilience in a regional shipping network. A transshipment hub can have improved connectivity to global maritime shipping, but feeder ports may experience a decline of connectivity. Another example is the digitalization decision by shipping lines and ports to improve their interface, particularly by setting up port community systems. This information platform supports the resilience of the ship/port interface through an enhanced exchange of information between key port users, such as shipping lines, terminal operators, beneficiary cargo owners (BCOs) and carriers.

- Port/hinterland interface: Relates to the interactions between ports, terminal operations and inland transport carriers. This includes infrastructure managers, logistics service providers, and the crucial relations with roads, rail, waterways, transport carriers, and their relations with dry ports, inland container depots, and port-related logistics facilities. The actions and strategies of hinterland actors can support or undermine port resilience. For instance, an improved inland transport infrastructure will increase hinterland connectivity of a port and, by extension, its resilience by ensuring that cargo continues to flow from/to the hinterland to/from the global market.

In some cases, and when not implemented properly, actions by stakeholders may have the unintended effect of causing or amplifying a port disruption and creating additional points of failure. These may not be directly and physically associated with the port interface and include: (i) shippers and cargo owners (providing the cargo); (ii) government agencies (overseeing regulatory aspects, customs, safety, security, and the environment); and (iii) the insurance, finance and banking sectors. For example, cargo owners could become a point of failure when they perform a major change in their procurement strategy, face labour shortages, or even bankruptcy. They may not be able to arrange for the pickup of containers in a timely fashion resulting in terminal congestion. They may also delay the return of empty containers and constrain their ability to export. Thus, shippers can also influence port resilience.

2.1 Defining port resilience

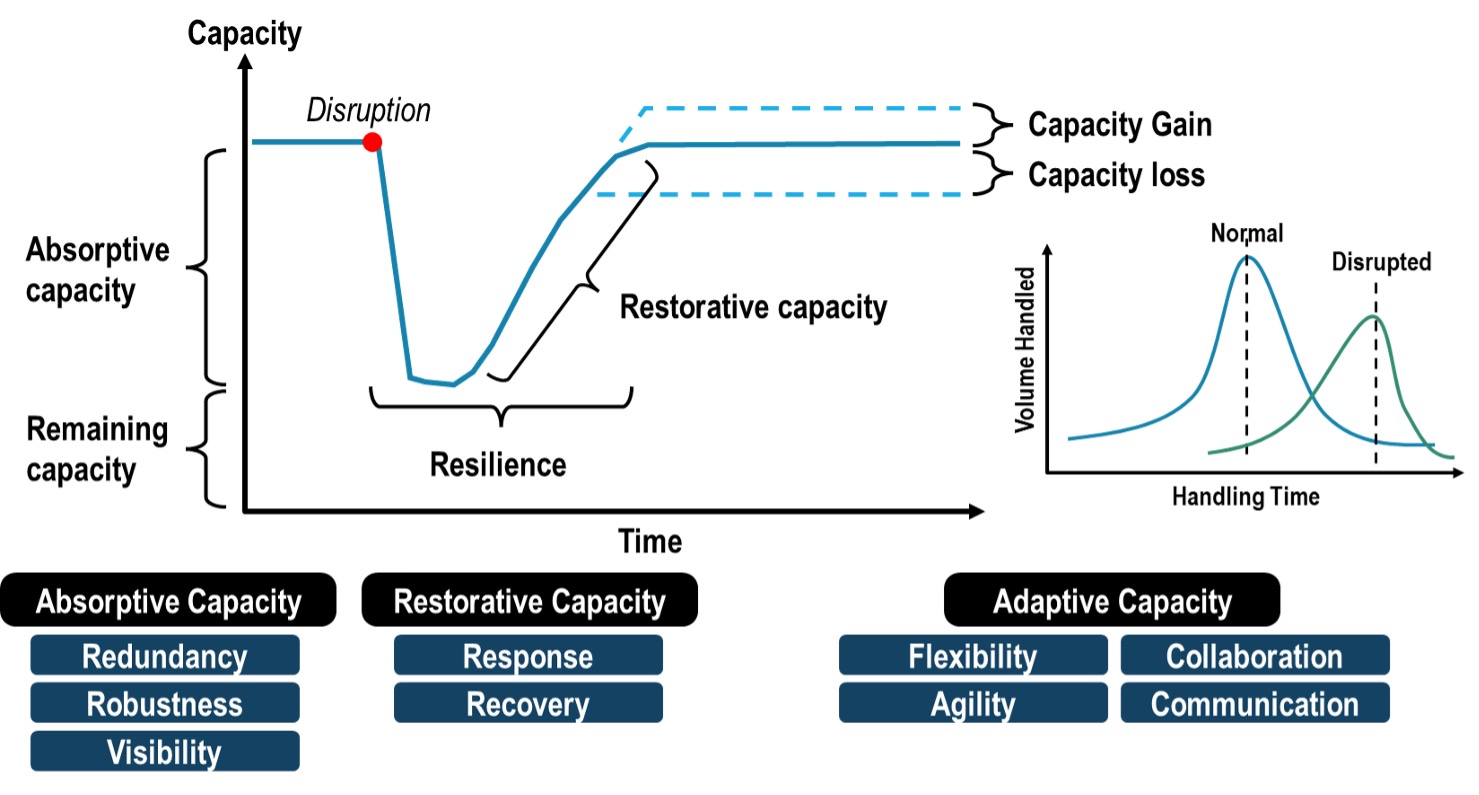

Port resilience is the ability to maintain an acceptable level of service in the face of disruptions (e.g. pandemics, natural disasters and cyber or terrorist attacks); this varies with port size, location and type of operations. Port resilience is largely determined by their ability to remain operational and offer services and infrastructure to ships, cargoes, and other customers during disruptions. In some of the existing literature on supply chain resilience, the concept is more narrowly defined to mean the time to recovery (TTR), as also illustrated in figure 2.

A resilient port can cope with shocks, absorb disruptions, quickly recover and restore operations to a level similar to – or even above – a baseline, as well as adapt to changing conditions, as it continues to develop and transform.

Port resilience is linked to its inherent properties as it is a capacity and capability issue, regardless whether port activity and traffic are present or not. For instance, if a disruption were to impact a port’s hinterland and reduce traffic and cargo flows, the port would be considered resilient if the disruption did not impair its capacity to handle an average traffic level and the corresponding revenue. A port's responsibility is to ensure that it is connected to the global shipping network and its hinterland, and to provide an expected level of infrastructure and services. Factors beyond these realms, such as a disruption at a large manufacturing facility using the port, cannot be effectively and directly addressed by the port. However, given the potential volatility in volumes they should not be considered elements of port resilience, even if they indirectly impact its operations. For example, if a demand surge is created after a manufacturing facility resumes its operations, a port’s capability to handle this surge is considered an element of its resilience. This does not infer that resilience only involves temporary cargo surges; it could also involve a systematic decline in volumes handled by a port, implying the need to adapt to a commercial environment generating less demand, which could be mitigated by adopting measures, e.g. cargo consolidation and the search for new opportunities and markets.

Figure 2: The concept of port resilience

Source: Linkov, I. and J.M. Palma-Oliviera (eds) (2017).

Resilience tests the capacity of ports in three different ways (figure 2):

- Absorptive capacity is the ability of a port or a terminal to absorb a disruption using existing infrastructure and services, while maintaining the same level of service. This implies attributes, such as robustness, redundancy and visibility. A robust system is said not to be impacted by some disruptions as it can withstand them. Ports have technical and engineering design characteristics allowing them to withstand geophysical disruptions, e.g. storms, for which they have a level of robustness. Through “redundancy”, ports are also able to withstand disruptions by being able to accelerate and expand their operations, or by being able to store additional inventory at terminals. Ports have a technical buffer (how much additional throughput they can handle) and a storage buffer (how much extra cargo they can store). Visibility allows port users to access information supporting their operations and make appropriate decisions. Providing real-time information during a disruption reduces any impact on related supply chains as decisions can be taken to defer or divert cargoes.

- Restorative capacity. The ability of a port to recover from a specific disruption to a level of service similar, or even above, a baseline. First is the ability of a port to provide a response to a disruptive event, mainly through its preparedness and the resources that can be mobilized to contain and abate the disruption. Second is the ability of a port to recover and return to a normal operational state with its associated capacity. After recovery, an outcome can be a capacity loss, as recovery leads to lower levels of efficiency. Another possible outcome is that the disruption becomes a "learning event", allowing for a capacity gain and more efficient operations.

- Adaptive capacity. The ability of a port to change its operations and even its management, either in anticipation of, or as a reaction to, a disruption. It involves flexibility, whereby a port can adjust its operations to mitigate disruptions, such as changing its schedule and workflows. A port can also display a level of agility and be able to respond rapidly to disruptions, including having a workforce capable of performing tasks they do not usually perform. Through collaboration, cargo can be routed through different terminals within the same port, or through different ports. If a port is part of a port system with a well-connected hinterland, its adaptive capacity can be improved by temporarily using other ports through collaborative efforts. Lastly, a port can rely on communication to inform stakeholders of the changes they are implementing to allow them to adjust their own operations. A port can also receive and process information from third-party providers, such as carriers.

The most common outcome of a port disruption is a temporary degradation of the cargo handling performance. Under normal circumstances, a terminal (or port) is expected to provide a performance level in which a notable share of the cargo is handled within a designated timeframe. With a disruption, the degradation of the performance can result in substantially longer handling time coupled with a lower capability to handle the traffic. In extreme cases, the disruption is significant enough to force a shutdown of operations. Once operations resume, port labor and equipment must catch up with the accumulated cargo waiting to be handled on both the maritime and inland sides. Other measurable outcomes to port disruption include a loss of revenue and customers. Although a port can have long-term agreements with shipping lines which bind cargo flows, disruptions provide incentives to carriers to reassess their commitments. Auxiliary services and activity clusters gravitating around the port can also be considered, as their performance and activity levels are closely associated with those of the port.

Disruptions can have two types of impacts on ports:

- Operational impacts impair port operations and cause delays, but generally leave port infrastructure and equipment intact. Operational impacts affect all elements of the maritime transport chains with, for instance, ships being delayed, terminals losing revenue, and cargo owners facing inventory shortages. An event, such as a storm, may occur within the port terminal’s design parameters but could nonetheless lead to a slowdown or cessation of port operations. Other notable disruptions can include power outages and labour movements, e.g. strikes. For example, the COVID-19 pandemic impacted port operations by creating labour availability issues due to sanitary measures. However, the most notable impacts were related to disruptions caused by a demand surge resulting from a rapid return in demand for containerized goods, which in turn were boosted by national stimulus policies and support for consumer spending. Several gateway ports and their hinterlands were not able to cope effectively. Yard capacity can be a significant operational constraint, as once a terminal reaches full capacity, it is unable to handle ships effectively. Shipping lines can decide to skip a port call, or alternatively wait until the facility resumes its operations.

- Infrastructure impacts. These relate to damage to, or even the destruction of, port infrastructure and equipment. The disruption takes place at a scale above the port’s design parameters. Although some infrastructure and equipment may not have been damaged, those that were damaged would impair regular operations until repaired. Since infrastructure impacts are usually of much longer duration than operational impacts, the port would be impacted by a loss of revenue, reputation and repair costs. These impacts would extend to activities directly dependent on the port that would be forced to find alternatives or be forced to curtail their operations until port activity resumes. Some actors, e.g. shipping lines, have more flexibility as they can allocate their ships to other ports and shipping markets while the disruption endures.

Additional information about Port Resilience is available in PART II of this guidebook.

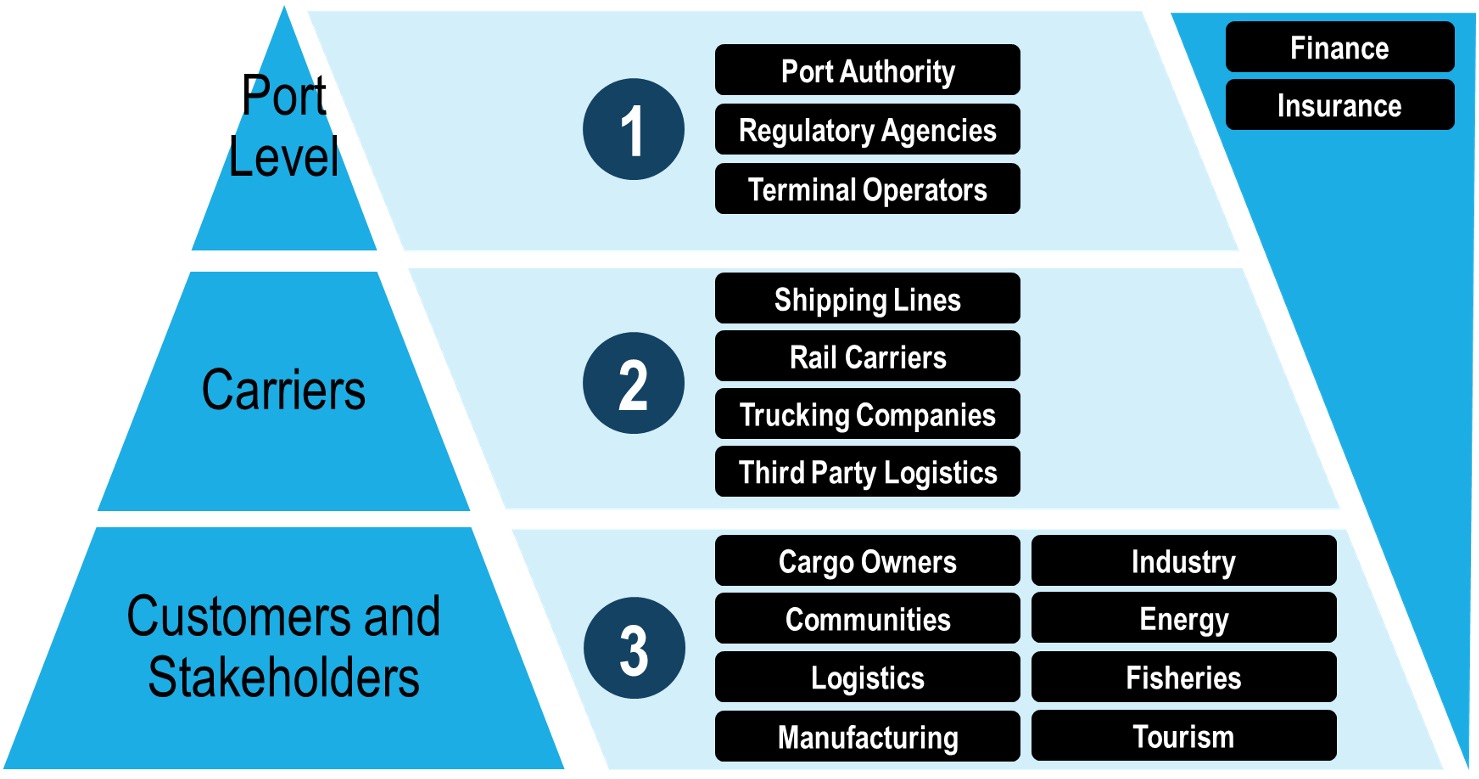

2.2 Actors enabling port resilience and layers of intervention

Various actors and stakeholders have jurisdiction over, and the potential to intervene on, port resilience related issues. These form part of the port resilience ecosystem and include the following layers (figure 3):

- First layer. Actors that are directly involved in a specific port through ownership, oversight, planning and operations. These include port authorities, government and regulatory agencies and terminal operators.

- Second layer. Actors that directly depend on a specific port for their carrying and handling cargo operations. These include shipping companies, ship operators, carriers, inland transport carriers, and third-party logistics service providers. Their actions have an impact on a port’s resilience, and its ability to cope with disruptions as they control freight flows.

- Third layer. Actors that are indirectly impacted by the performance of a port and related carriers, including cargo owners, industrial and manufacturing activities. Their actions can have longer term implications for port resilience and can influence the location and the extent to which their port-related facilities are used. There is also a range of co-located activities depending on the port, such as energy generation facilities, logistics zones, local communities and tourist activities.

- Meta-layer. External factors that are pricing port resilience through the valuation of risks. These mainly include stakeholders from the financial and insurance industries involved in covering risks related to capital investments and commercial loans and the operations of shippers, terminals and cargo.

Figure 3: Actors and layers of intervention in port resilience-building

3. The Port system and its risk factors

3.1 The Port interface

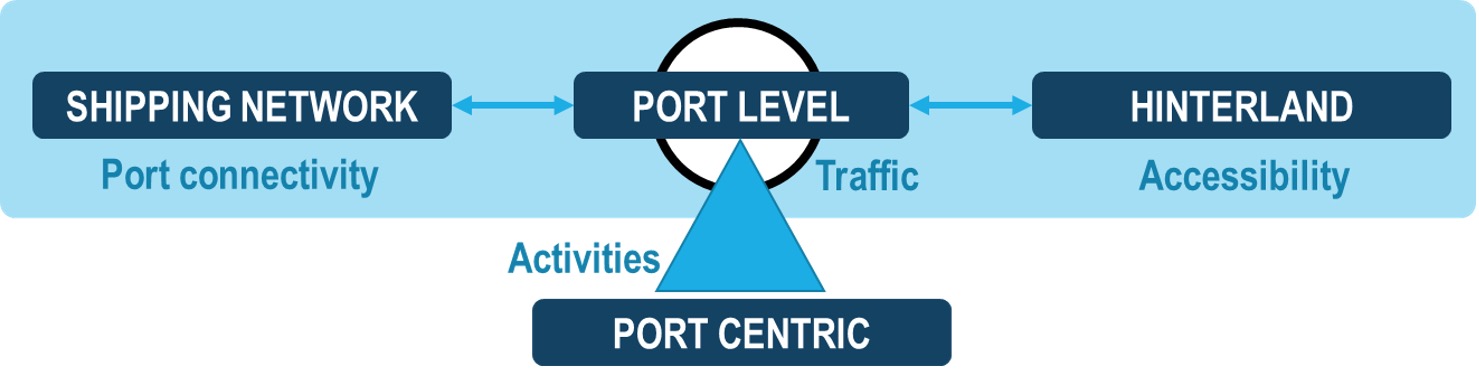

Ports are connectors within supply chains and the interface of two systems of circulation. The first is the shipping network and its trade connectivity; and the second is the port hinterland with its commercial accessibility. Port-centric logistics, energy production and manufacturing can be considered as the third element of the port interface (figure 4).

Figure 4:The port interface: The hinterland and the foreland

The port interface underlines the potential for propagation and back-propagation effects, which can also be referred to as a network contagion effect. The port is part of a complex network that includes information systems, workforce, supply chains, carrier services, financial transactions, and energy provision. The manner in which a port is embedded within these networks is an essential component of its resilience. A failure in one network can have substantial impacts on others and on the particular feedback over a port.

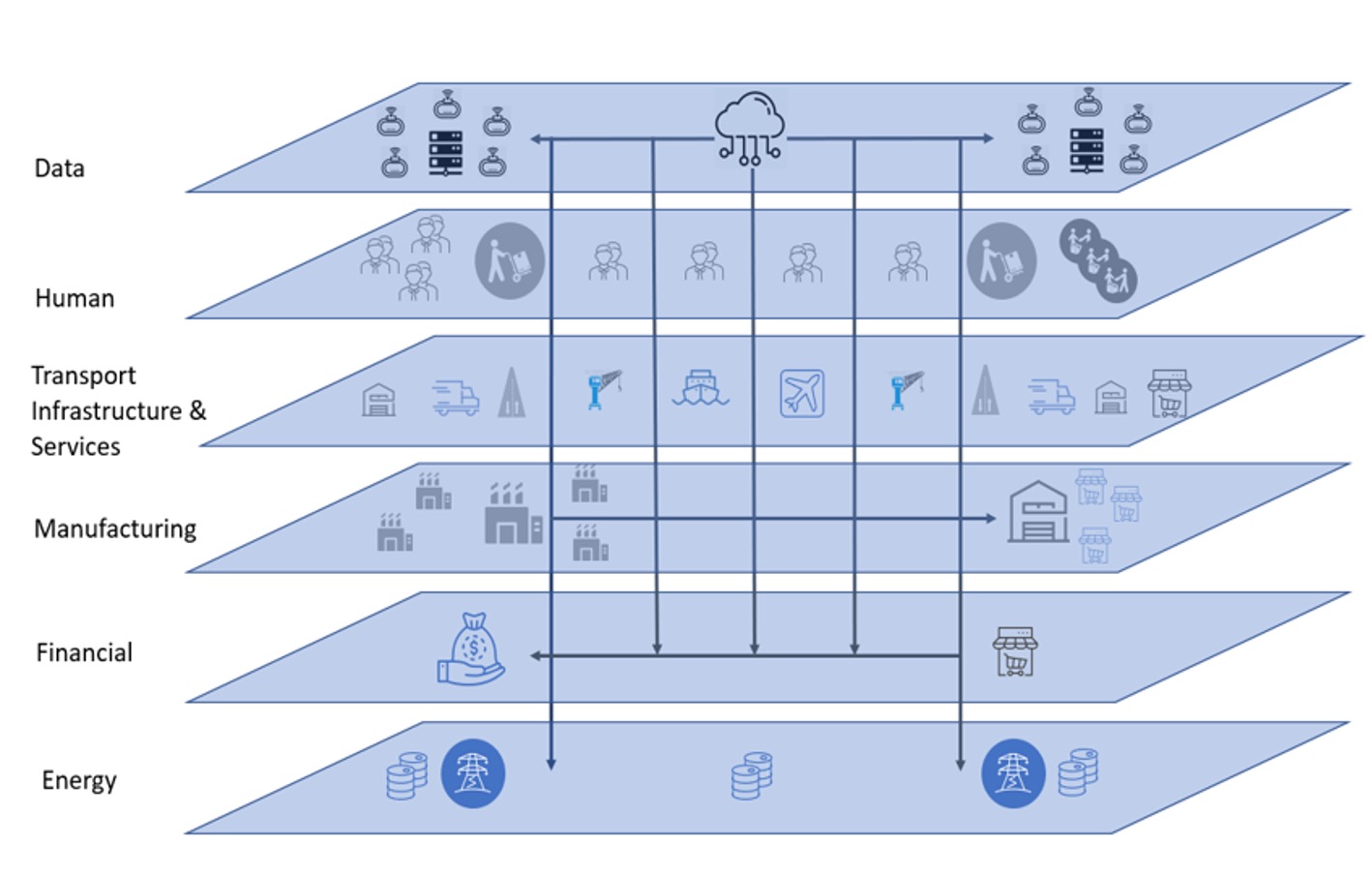

The logistics network, including shipping, ports and their hinterland interacts with other networks such as labour, energy and technology (figure 5). A failure of one network can have catastrophic impact on another. ‘Risk propagation’ associated with network and compound risks, as detailed further below in this guidebook, entail ripple effects within and across networks i.e. including not only up and down the logistics ‘plane’ (shipping network, port level, hinterland) but also on a cross-network basis.

Figure 5: Networks risks

Source: Manners-Bell J. (2022).

3.2 The Shipping network

Since the 1990s, globalization has enabled the expansion of international trade, as well as the outsourcing and offshoring of manufacturing. Over this time, maritime supply chains, which include shipping networks, ports and hinterland transport operations, have expanded, largely due to the growth of container shipping services.

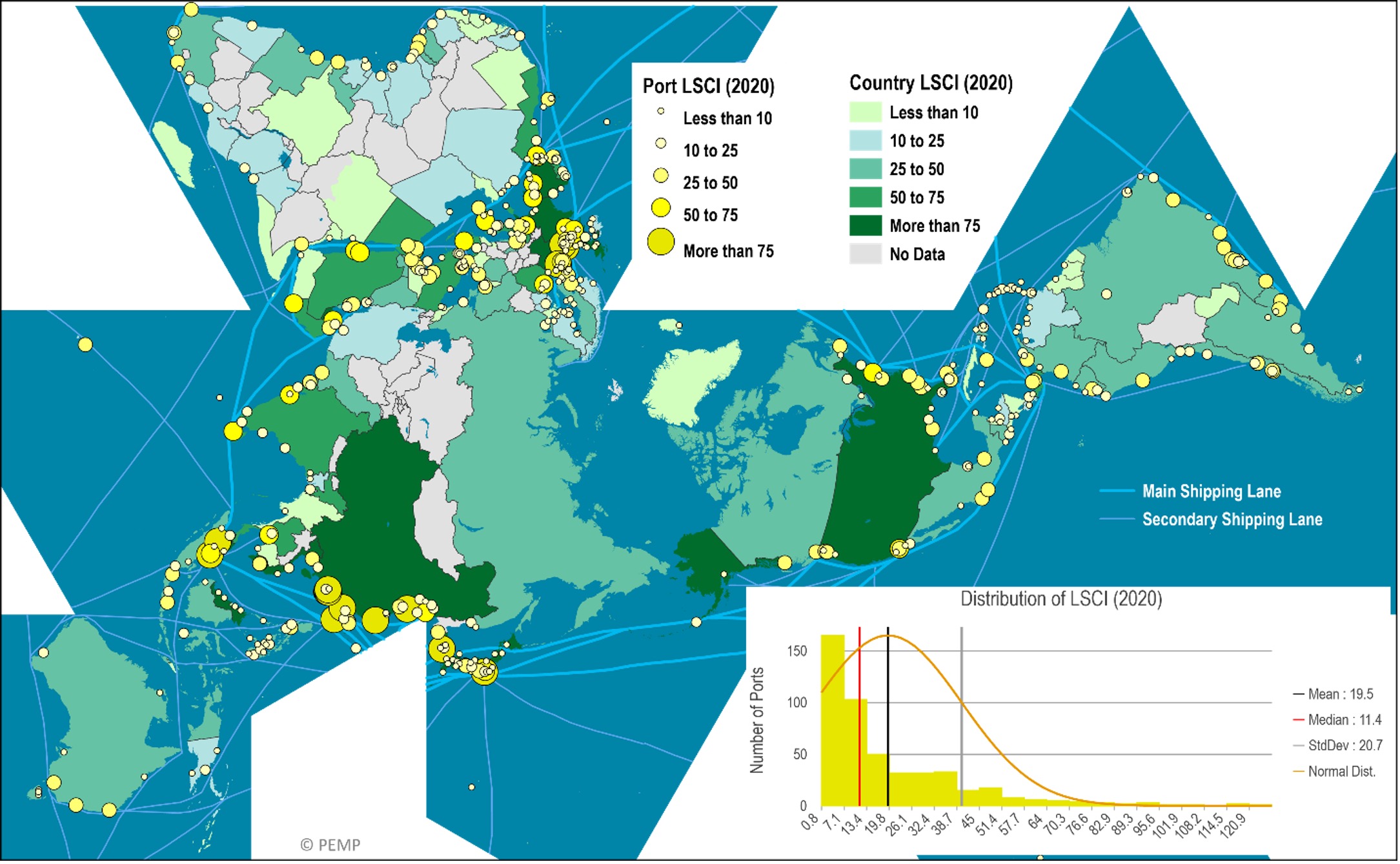

The configuration of the global liner shipping network can be represented through maritime connectivity, as measured by the Liner Shipping Connectivity Index (LSCI). It reveals a high concentration level among a small group of highly connected ports that act as gateways and hubs of global trade (figure 6). In 2020, 25 ports accounted for 17.7 per cent of the accumulated connectivity. Countries with the highest LSCI values are actively involved in international trade. The export-oriented economies of China and Hong Kong (China SAR), rank first, with the Singapore transshipment hub ranking third. Large traders, e.g. Japan, Germany, Republic of Korea, United Kingdom and United States, rank among the top 15. Countries such as Egypt, Malaysia, Oman, Spain, and the United Arab Emirates also rank high because of the major transshipment function of their ports. High concentration levels can expand the scale of disruptions, particularly when they involve ports or countries having high connectivity levels.

Figure 6: Maritime container shipping connectivity

Source: Based on data from MDST, https://www.mdst.co.uk.

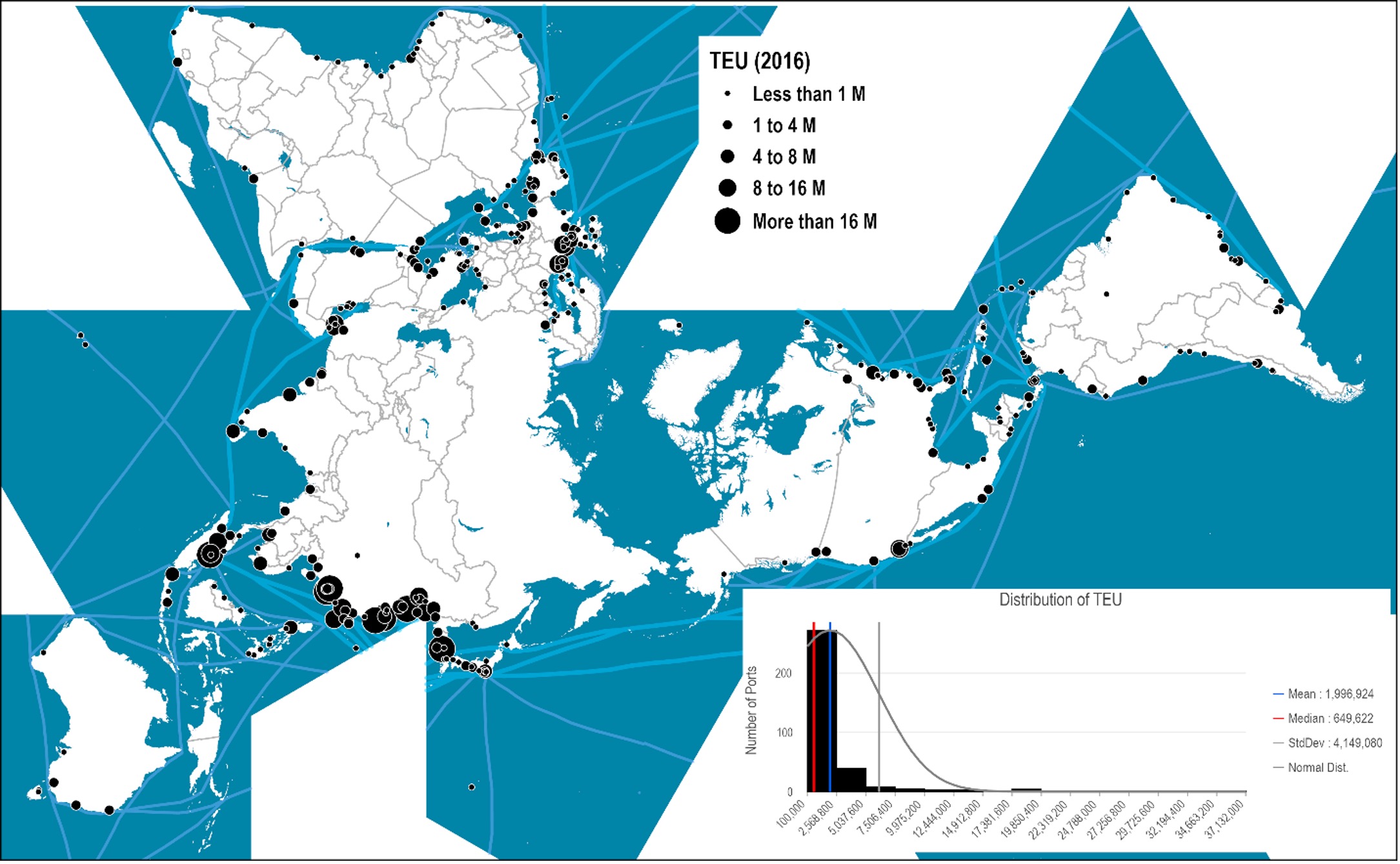

3.3 Container port handling and traffic

The level of container port traffic is reflective of the world's commercial geography and the handling of finished and intermediate goods (figure 7). Commodities, such as grain and lumber, are becoming more prevalent in container shipping but remain a niche market. Before the 1990s, the world's most important ports were North American (e.g. New York) and Western European (e.g. Rotterdam). Globalization, supported by containerization, changed the world's commercial geography with the emergence of new port locations, and reflected changes in the global geography of production, distribution and consumption. This new global geography indicates a high level of traffic concentration around large port facilities, notably Pacific Asian ports along the Tokyo-Singapore corridor. The 25 largest ports accounted for 49.8 per cent of twenty-foot equivalent unit (TEU) traffic, highlighting the vulnerability of global shipping focusing on a limited number of ports. Any significant disruption in the leading 25 container ports will have a ripple effect on other shipping networks through delays in services, which will cascade through other connected ports.

Figure 7: Container port traffic

Source: Based on data from J.P. Rodrigue, Global Container Port Database.

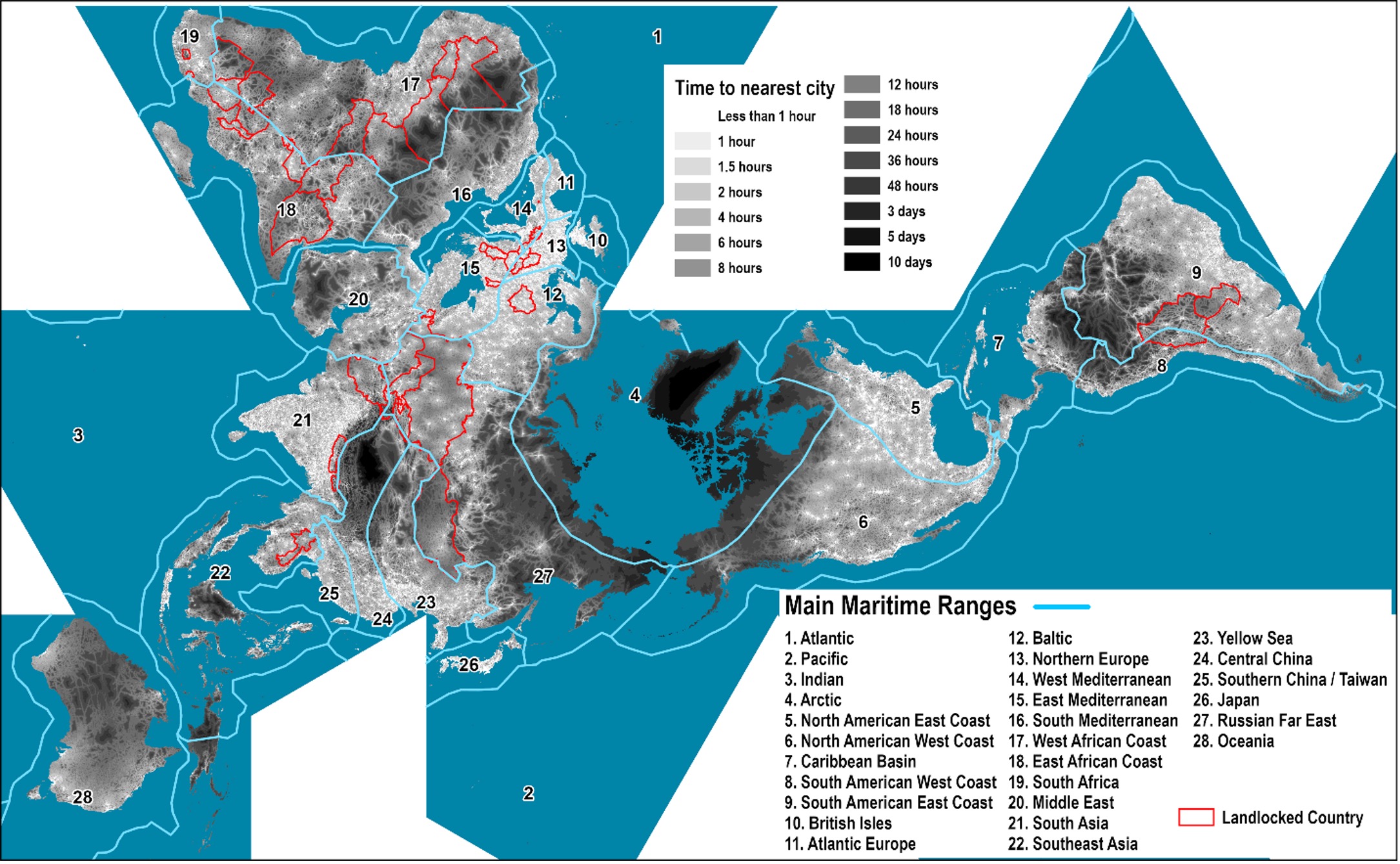

3.4 Hinterland access

Maritime shipping services are commonly established to connect maritime ranges, which occasionally mark the extent of regional feeder services, such as the case in the Caribbean and the Baltic regions. Some maritime ranges and their hinterland have high levels of access levels, particularly when connected by high-capacity rail corridors, as in the case in the east and west coasts of North America (figure 8). Other maritime ranges are discontinuous and barely connected, as in the case of SIDS in the Caribbean, Pacific and Indian Ocean, or marginally connected, as in the east and west coasts of Africa.

For a given port, the hinterland contestability (i.e. the prospect for other ports to capture the cargo from/to the hinterland) affects its resilience. When a hinterland has a low or no contestability (i.e. not having more than one port option to route their cargo), it implies that the port handling trade from/to this hinterland, has access to a secure market base. This positively affects its resilience. However, such a port remains vulnerable to any significant downward change in demand.

Figure 8: Maritime ranges and hinterland accessibility

Source: Nelson A. (2008).

A hinterland (country) that does not have direct access to the ocean obliges it to use ports in a third country through a land (rail, road, internal waterways, or multimodal) corridor, and negotiating an access regime. This implies higher transport and trade costs impacting their economic competitiveness. If containerized imports are considered, landlocked countries have a cost structure that is about 85 per cent higher than the world average (World Bank, 2020). From a resilience perspective, these countries are particularly vulnerable because of the effects that higher transportation costs can have on their trade and costs (Box 1).

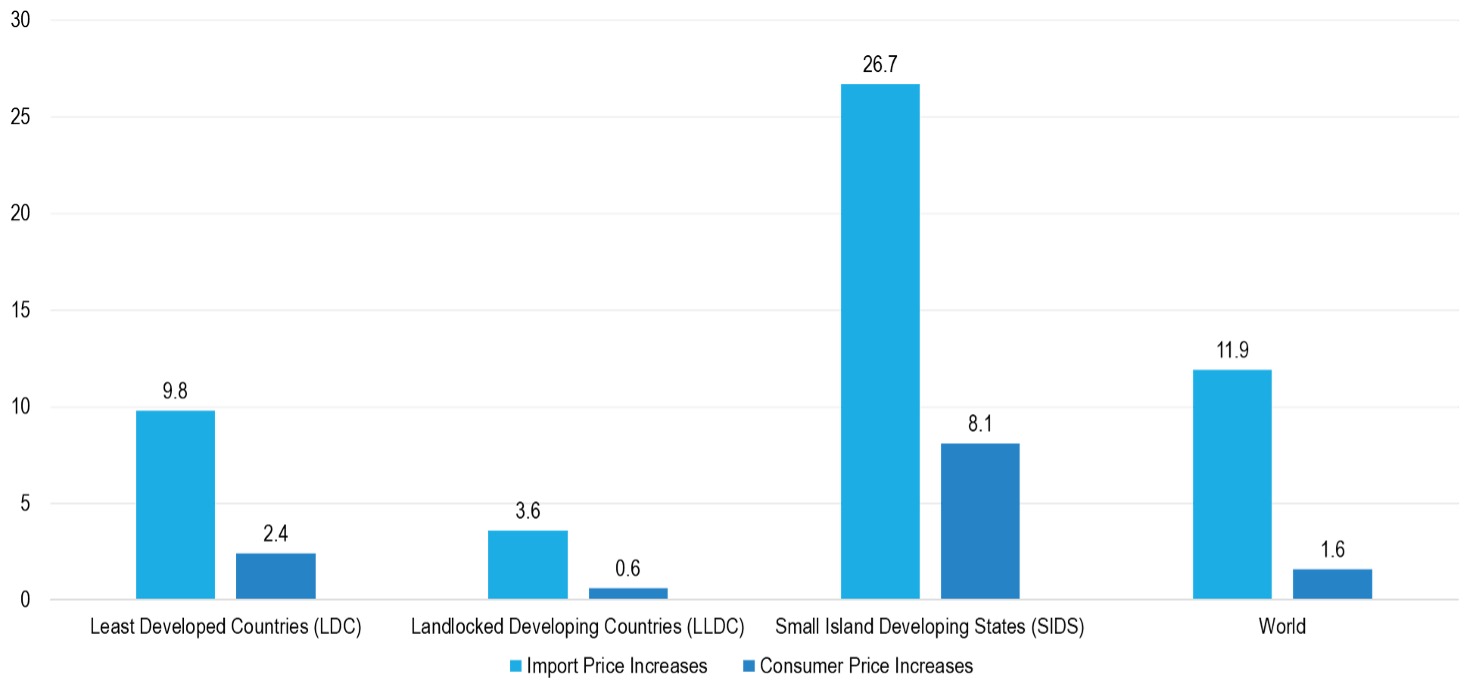

Box 1: Impact of freight rate surges on import and consumer prices

According to UNCTAD analysis, the surge in container freight rates caused by COVID-19 disruptions, if sustained, could increase global import price levels by nearly 12 per cent and consumer price levels by 1.6 per cent (figure 9). Demand for goods surged in the second half of 2020 and into 2021, as consumers spent their money on goods rather than services during pandemic lockdowns and restrictions. Working from home, online shopping, and increased computer sales placed unprecedented demand on supply chains. This large swing in containerized trade flows was met with supply-side capacity constraints, including container ship carrying capacity, container shortages, labour shortages, ongoing COVID-19 restrictions across port regions, and congestion at ports. This mismatch between surging demand and de facto reduced supply capacity led to record container freight rates on practically all container trade routes. Cargo owners faced delays, surcharges, and other costs, and still encountered difficulties in ensuring their containers were moved promptly. The impacts of the high freight charges are greater in SIDS, which could see import prices increase by 26.7 per cent and consumer prices by 8.1 per cent. In least developed countries (LDCs), consumer price and import price levels could increase by 2.4 per cent and 9.8 per cent, respectively. Low-value-added items produced in smaller economies could face serious erosion of their comparative advantages. A surge in container freight rates will add to production costs, rising consumer prices, and slowing national economies, particularly in SIDS and LDCs, where consumption and production are highly dependent on trade.

Source: UNCTAD (2021). Review of Maritime Transport 2021. Geneva.

3.5 Port-centric activities

On a local scale, ports support an ecosystem of activities consisting of port users directly dependent on its capabilities. Such port clusters usually include: (i) logistics and warehousing; (ii) manufacturing; (iii) heavy industries (e.g. petrochemicals); (iv) energy production; and (iv) transformation activities. This cluster is highly interdependent with port activities, implying that its resilience is based on the capability of the port to handle its cluster’s inputs (coming as imports) and outputs (coming as exports). Under normal circumstances this co-dependency is a factor of efficiency, but can be a vulnerability in the event of a disruption.

3.6 Port risk factors and challenges to resilience

As previously noted, port resilience is regularly being challenged by disruptive events that can be internal, and under the control or influence of stakeholders, such as shipping lines, port authorities and inland carriers, or influenced by external causes of a natural or anthropogenic nature. Most disruptions tend to be local in scale and scope, but there are occasions when disruptions can become wide-ranging and affect a whole region, network segment, or in extreme cases, have global ramifications.

Figure 10: Port risk factors and challenges to resilience

Source: Adapted from Kim, Y., and L. Ross (2019).

Several internal and external risk factors to the maritime transport sector, or the port ecosystem, can become disruptive and test a ports’ resilience (figure 10). Internally, these risk factors originate from within the three segments of the maritime supply chain:

- Shipping network. A ship’s change in a route, scheduling and service configuration can result in a decline or rise in volumes, which can negatively affect the affected ports. A simple change in scheduling involves operational adjustments in terminal work hours and gate traffic. A port’s capability to handle these changes can reflect its operational resilience. Economies of scale applied to maritime shipping have also tested the resilience of ports to adapt by upgrading their infrastructure and operations. Larger containerships, requiring channel and docking clearance, adequate terminal equipment, yard space and operational surges, can challenge a port’s capabilities. The navigation channel approaching a port can also be subject to potential navigation disruptions because of depth and width limitations. Conflicts with different shipping services, e.g. ferries, cruises, barges and bulk and break-bulk ships, can create contested navigation channels, and limit the range of port activities, and the number and type of ships they can handle. An additional challenge is the on-going concentration of shipping lines, at both the individual shipping line level and through alliances.

- Port level. Governance could be ineffective at the port authority, or terminal level, and could lead to delayed decision-making and responses to disruptions, particularly if the hierarchical structure of the port authority relies on only a few key managers. There could also be a lack of regulatory oversight, implying that rules and regulations are not sufficiently monitored and enforced. This can pose a risk when hazardous materials are being handled and stored. Port infrastructure and equipment require a maintenance and upgrade cycle that must be monitored. Lapses can lead to failures, breakdowns and a decline in reliability. As the demand for container shipping has grown across the world, so has the demand on a port’s footprint or extent. Several ports have faced a land scarcity issue, which has not only limited their expansion potential but has also become a source of conflict with local communities. Lack of space can become a challenge to port resilience as it limits a port’s options for growth. When feasible, ports have responded to this challenge by relocating to new sites, resulting in an expanded footprint and related operational flexibility. Ports are large energy consumers and can face provision challenges, particularly in the context of on-going decarbonization efforts among the shipping and logistics industry. Changing port energy supply systems could be disruptive as new systems, e.g. wind energy, could be associated with new forms of vulnerability.

- Hinterland. Ports are generally integrated with their hinterland through transport corridors and inland facilities, such as dry ports and empty container depots. Maintaining and improving this connectivity can be complex and requires a collaborative framework involving: (i) cargo; (ii) land infrastructure managers, e.g. rail, highways, inland navigation; and (iii) cargo owners using the port, e.g. manufacturers, retailers. Lack of coordination between these actors could lead to capacity shortages or failures across segments of the inland transport system.

Additionally, the following internal risk factors are cross-cutting and common to the three maritime supply chain segments:

- Labor. The port industry requires an increasingly diverse set of labour skills to operate sophisticated equipment, manage operations and oversee complex information systems. Recruiting, training, and retaining this labour can be a challenge. Failure to do so impairs not only the operational capabilities of the port system but its ability to effectively recover from disruptions. The COVID-19 pandemic highlighted the crucial importance of maritime labour, ranging from seafarers, port terminal workforce to truck drivers.

- Cybersecurity. Maritime supply chains are increasingly relying on IT to manage operations and to transfer documentation (e.g. bills of lading). Digitalization along the maritime supply chain underlines the need to focus on cybersecurity to safeguard the integrity and availability of critical data, secure operations and to protect maritime infrastructure. A growing number of cybersecurity incidents have occurred in recent years, including the Maersk Petya attack of 2017, as highlighted in the Case Study on the Jawaharlal Nehru Port Trust and the 2021 South African port disruptions.

- Safety and security. Theft, piracy and terrorism have come into sharp focus in recent years, especially after the events of 11 September 2001. This has led to the review and implementation of a range of port and maritime security measures, including through supply chain security-related instruments, such as the Framework of Standards to Secure and Facilitate Global Trade (SAFE Framework, 2005) adopted under the auspices of the World Customs Organization (WCO). Additionally, the Authorized Economic Operator (AEO) concept was introduced to allow certified entities, e.g. carriers and cargo owners, to be considered as a lower risk factor.

A series of other risk factors are external to the maritime transport ecosystem. These can have a significant impact on port resilience by directly affecting the port or its users, such as shipping lines and inland carriers:

- Natural hazards are conventional natural forces, e.g. hurricanes and other extreme weather events, that can impact port and shipping activities.

- Anthropogenic hazards are forces derived from human activities, intentional and unintentional, that can impact port and shipping activities. Examples include accidents and cyberattacks.

- Market changes involve sudden or gradual changes in supply or demand patterns which can impact global trade and supply chains. These include economic cycles, e.g. market crashes, recessions, and commodity and energy price shocks.

- Access to finance. A port’s ability to access financial resources is critical to cover the cost of operations or for capital investment. Being unable to secure sufficient funding can be considered a risk factor undermining the capabilities of a port to cope with changes.

- Environmental impacts. Environmental conditions, such as pollutants, water contamination and noise that impair port activities and the health of the workforce. Efforts that aim to mitigate impacts or provide remedy can also result in additional burden.

- Trade policy are policies and regulations implemented by governments to impede and restrict the importation and exportation of specific goods; they can also involve a change in regulatory status, such as the creation of a free zone, which can impact the comparative cost structure of the goods being handled by a port.

- Geopolitical events, e.g. conflicts and civil unrest, are highly destabilizing events for port activity in impacted areas. These impacts can be unforeseen and have dramatic consequences on port activity. Russia’s invasion of Ukraine in February 2022, and its blockade of Ukraine’s Black Sea ports is an example of the unforeseen impacts of geopolitical events on ports.

3.7 Disruptions to third-party suppliers

Ports not only support supply chains but also need to ensure the smooth functioning of their own supply chains; the latter requires a procurement process which can supply ports and terminals with: (i) construction material; (ii) maintenance and repair of equipment; (iii) supply spare parts, energy; and (iv) other essential items to maintain operations (figure 11). These supply chains are provided by third parties and can be subject to disruptions, which would compound their impact and undermine port resilience. Port activities also generate wastes that need to be processed, recycled and discarded.

Figure 11: Third-party suppliers supporting port operations

Each element relating to third-party suppliers has a lead time, and procurement needs to allow for sufficient time to ensure access to required supplies (e.g. goods and services). For some procurement, the lead time can take years, whereas some utilities, e.g. electricity and water, can be supplied in real-time. For instance, once ordered from a manufacturer, a crane can take up to two years to be delivered. The port maintains an inventory level that should allow for the rapid repair or replacement of defective components, so that operations can be maintained. If a component is not available and has a long lead time, a disruption could endure for as long as the component has not been replenished.

The financial strength of third parties, such as port subcontractors and suppliers, can also be an indicator if they are solvent and robust, should a disruptive event occur. Relying on multiple suppliers and sources is a possible port resilience strategy, but every additional supplier brings additional negotiating and contracting costs. Another approach when a port is facing third-party risk or uncertainty is to hold buffer or safety stocks at the port, or at a convenient local storage facility. A buffer stock is the level of extra inventory maintained to mitigate risk due to uncertainties or events which may alter the demand for, or supply of, port operations. Third-party suppliers need to be agile and can contribute to resilience by, for example, offering procurement options and having a presence in a port’s hinterland.

Finally, port activities generate waste, including discarded parts and equipment, that must be appropriately handled. Resilience can involve the capability of a port to discard, re-use, re-manufacture or recycle its waste.

4. Building port resilience: A step-by-step approach

An overview of port-related supply chain disruptions, including the COVID-19 pandemic, emphasized the position of ports as single points of failure with significant ramifications upstream (i.e. a shipping network) and downstream (i.e. a port’s hinterland). Depending on their nature, disruptions imply costs and delays for ports, port operators, port users (e.g. cargo owners), and inland carriers (e.g. railways, barges, trucking). Ports and their users make decisions and take actions that can enable or undermine its resilience. The cost implications of disruptions at a port are such that there is a substantial return to be made on appropriate resilience investments.

Port resilience starts with the commitment of its management. Several elements need to be considered by a port to create resilient practices, including its governance capabilities, which can minimize known risks and scan the horizon for emerging threats and opportunities. An appropriate governance structure and relevant support is key to developing commitment and assigning ownership and accountability for port risk management. Emphasis should also be placed on the value of appropriate and controlled risk-taking, which is essential to developing a risk culture in ports. Further, responsibilities must be allocated and authority delegated.

Most risk management frameworks and systems are only designed to manage “slow risk clock speed” risks. While information needed is sufficient and available before the extreme event, most extreme events, will not fit into this category. As a result, ports also need a “fast risk clock speed” perspective and understanding when managing risks. Ports need to be able to address the various types of risk problems and protect themselves from reputational damage.

Devising and implementing a strategy to enhance preparedness and port resilience in the face of disruptive events requires at least five action-oriented steps, involving (figure 12):

- The identification of hazards from a wide range of natural and anthropogenic disruptions that are specific to the port being considered.

- Assessing vulnerability and potential impacts by identifying port-specific risks, levels of exposure to risks, and the potential consequences of a hazard.

- Elaborating response and mitigation measures involving port infrastructure and processes related to port management and operations. These measures can aim for prevention and preparedness (before the event), or be responsive and adaptive (after the event), with both aiming to speed up the port activity recovery.

- Prioritizing response and mitigation measures that had been elaborated using prioritization analysis, such as cost-benefit analysis and resource allocation for finance, labour and other resources. This step will help to focus on the most important strategies.

- Implementing response and mitigation measures that have been prioritized and elaborated through their deployment across the port ecosystem. Once these measures have been implemented, a review process should follow to assess their effectiveness and make any requisite adjustments that may be required.

Figure 12: Port resilience-building process: A stepwise approach

These above-mentioned steps for port resilience building set out a generic framework that can be tailored and adapted to the existing context of ports, depending on the size and profile of the port and the development stage of the countries involved. Each port tends to have a different geographical, economic, political and managerial context, their risks categories and exposure as well as their ability to cope and respond to disruptions, are also likely to vary. The most common questions and concerns involve:

- Which risks should be prioritized from a port’s perspective;

- Which stakeholder has responsibility for adopting response measures to mitigate impacts, adapt and recover from disruptions;

- Which actor should be involved in case of a specific disruptive event, this would allow for the implementation of stakeholder developed plans and strategies;

- What are the costs of response and mitigation measures and implementation timelines;

- How outcomes reviewed, and how are the lessons learned integrated into the resilience-building process.

Step 1: Identify the hazards impacting ports

The term hazard refers to the source of disruption and how extensive or damaging this disruption could be. Risk refers to the likelihood that a hazard will occur within a specified timeframe. Figure 13 provides a comprehensive but non-exhaustive list of potential hazards or sources of port disruptions. The first essential step is to establish a port resilience-building strategy. The aim is to build awareness on the hazards that have already affected the port, or could potentially occur and identify their type.

Figure 13: Step 1 – Identification of hazards impacting ports

One suitable approach to identifying hazards is to consider past experiences (the recurrence of hazards) and events that took place at similar or neighbouring ports. This helps to determine whether the port may be vulnerable, as well to identify any future risks that may be expected, together with the likelihood for these events to occur, considering a port’s characteristics and setting. This assists a port’s management (i.e. its board and senior management) to identify the specific hazards that are the most likely to occur. In other words, port management determines the hazards that present the highest risk. Hazards that may disrupt ports can be grouped into two fundamental categories, namely natural disruptions due to:

- Extreme weather events, particularly storms, floods, typhoons and hurricanes;

- Geophysical disruptions, such as earthquakes, tsunamis and volcanic activity;

- Climate change factors, such as the compounding effect of natural and anthropogenic changes on weather systems, e.g. precipitation levels and drought. The risk of sea-level rise is particularly salient for the maritime industry.

Anthropogenic disruptions such as:

- Accidents include equipment failure, crane breaking, containers collapsing, channel blockage, chemical leakage, explosion or fire.

- Geopolitical events, including wars, civil unrest, military coups, and sanctions.

- Labor-related issues such as strikes, labour shortages, and the lack of skills.

- Information technologies, such as IT failure and cyber-security breaches.

- Economic and financial events, such as economic cycles, insolvency of third-party suppliers and financial crises.

- Sanitary threats, such as pandemics and virus outbreaks.

Data from Everstream Analytics shows that the main source of disruption in developing countries’ seaports are related to weather events. Figure 14 features the top six disruptions across developing countries in 2021 by share of incidents. Figures 15 and 16, respectively, set out the top 10 countries and top 15 ports experiencing the most disruption in 2021.

Figure 14: Top six disruption sources in ports of developing counties, 2021 (percentage of incidents)

Source: Everstream Analytics, 2021.

Figure 15: Top 10 countries by share of incidents, 2021 (percentage)

Source: Everstream Analytics, 2021.

Figure 16: Top 15 ports by share of incidents, 2021 (percentage)

Source: Everstream Analytics, 2021.

See PART II for a more detailed description of each of these hazards.

Step 2. Assess the vulnerability of ports to disruptions and potential impacts

Once a list of the most important hazards potentially impacting a port has been established (see Step 1), the second step involves their categorization as risks. An explanation of the type and scope of the risk category needs to be provided, as well as their features, how they can occur and affect ports, and their resilience and the likelihood a disruption may occur (figure 17). Risks can be quantified using the risk=probability x severity method (figure 18).

Figure 17: Step 2 – Assessment of port vulnerability and potential impacts

Figure 18: Quantifying risks

Source: Manners-Bell J. (2022).

Each hazard that may impact a port has an associated risk category. While the list identified in Figure 17 is not exhaustive, it nonetheless reflects the various types of risks often associated with port disruptions. These include:

- Operational risks. To what extent does the hazard impact a port’s or terminal’s capacity to operate and offer services to ships, cargoes and other clients (e.g. clusters or activities in the proximity of the port). These indirectly impact global value chains which may be heavily dependent on well-functioning shipping and ports.

- Competitive risks. To what extent does the hazard impact a port’s or terminal’s competitiveness vis-à-vis its customers (e.g. shipping lines, cargo owners), and hinterland stakeholders.

- Financial risks. To what extent does the hazard impact a port’s or terminal’s revenue, operating costs, insurance rates and credit rating.

- Governance risks. To what extent does the hazard impact a port’s or terminal’s management and planning processes.

- Reputational risks. To what extent does the hazard impact a port’s or terminal’s public image, standing and customer perception.

These risks are cumulative, meaning that a single event could not only disrupt operations but also: (i) create reputational risks; (ii) generate a loss of business and revenue to the benefit of other ports or modes of transport; (iii) cause delays and congestion; (iv) labour shortages; or (v) result in a lack of storage areas.

Several risks are interconnected, with compound risks defined as risks that are non-independent. The compounding effects of one or more other risks could influence the probability and the severity of any other individual risk. For example, equipment failure can increase the risk of additional equipment failure as functioning equipment can become overburdened. A cyber-attack could impact IT systems related to payroll and equipment, compounding its deleterious effect across terminal operations. Furthermore, more than one hazard can occur at once, and exacerbate the situation. For example, a port could be simultaneously impacted by a pandemic or a seasonal hurricane, while concurrently facing a labour shortage due to pandemic-related restrictions and constrained financial capacity.

The consequence of any given event could be greater than the sum of each individual risk. Since the maritime transport system is organized as an interconnected network, with ports as core nodes, the compounding effects of risks serve as propagation and back-propagation mechanisms. Risk positioning and propagation considers which elements of the maritime transportation chain may be impacted first, and how the disruption may propagate (or back-propagate) along the transport chain. This mechanism illustrates the compounding effect of risks in the maritime industry:

- Shipping network. The risks involved in a shipping network can lead to changes in – or to a reduction in or lack of – ships carrying to ship services capacity, shipping service reliability, or schedule reliability. The ship call configuration of maritime shipping services can also be modified, dropping a port, and reducing the frequency of port calls. Excess capacity can also be a risk, since it could result in the removal of shipping services and ports of call, thereby impacting the frequency of procurement for port-centric supply chains.

- Port level. Any change in risks – or to a reduction in or lack of – can affect the performance, reliability and costs of port services. As in the case of shipping lines, excess capacity can also be a risk for ports as it is associated with lower returns on investments and excess labour, which could lead to layoffs and undermine revenue.

- Hinterland. Risks involving changes in capacity (i.e. a reduction in or lack thereof) can affect performance and the reliability of hinterland services, including trucking, rail and barges. Excess capacity risks are less common over hinterland transportation, but building unnecessary infrastructure or services is a risk as it may not provide a sufficient return on investment.

Understanding the potential disruptive propagation mechanisms along maritime transport chains is important. For instance, a labour strike at a port may impact its capability to meet expected key performance indicators (KPIs), but could back-propagate over the shipping network as ships could spend more time at the port (e.g. waiting at anchor), which then impacts their schedule integrity. In such situations, the performance of other connected ports is also impacted. The disruption could also propagate through the hinterland connectivity with longer gate waiting times and slower yard operations.

The disruption of a critical infrastructure asset can lead to a port experiencing a first-order disruption (figure 19, Layer C). As any affected port is connected to other assets, as well as foreland and hinterland connectivity (layers A and B), second-order disruptions occur through propagation. The capability of the port to handle hinterland traffic and shipping services is impacted until the first order disruption is resolved. For instance, a power outage in critical infrastructure servicing a port could create a first-order disruption and impair operations (e.g. by relying on generators). If long-lasting, this disruption will then propagate to become a second-order disruption, which in this case will impact the hinterland and maritime connectivity of the port. Ships could be forced to wait at anchor or diverted to another port.

Figure 19: Disruption propagation in a port network

Source: Adapted from Verschuur, J., R. Pant, E. Koks, et al (2022).

Once the vulnerabilities to each identified hazard are assessed as a risk, they can be ranked by levels of priority (risk prioritization). The lack of predictability limits the value of risk assessments for events with a low probability, but which could have severe consequences. Furthermore, any resilience strategy must include considerations on unknown risks (Black Swan events).

- High priority risk. A hazard that is identified as high risk and could have critical consequences for port operations, including stopping operations, and has a good and predictable likelihood to take place. Ports in areas where there is a recurring risk of high impact natural hazards, e.g. extreme weather events, such as hurricanes in the Caribbean and typhoons in East Asia, are giving high priority to these risks.

- Average priority risk. This covers hazards that have been identified as having an average risk of occurring, but which could have significant consequences for port operations (e.g. disrupting operations) should they occur; these hazards are considered to have a reasonable but difficult to predict likelihood of taking place. Information technologies are an emerging risk that could have a notable impact on port operations in the event of a successful cyber-attack.

- Low priority risk. Hazards identified as having a low and unpredictable risk of occurring could have consequences for port operations and marginally disrupt operations. Accidents and equipment failures are usually disruptive but tend to have a limited impact.

- Unknown risk (Black Swan events). A hazard identified as a risk that deviates beyond what is normally expected, and which is extremely difficult to predict. These events are very rare, but their impacts can be substantial when they occur. This is the reason why they are usually referred to as “crises”. While not “Black Swan” events per se, the COVID-19 pandemic and the financial crisis of 2008-2009, however, are two notable examples of a risk beyond what is normally expected. Preparing for such risks is difficult since their likelihood of occurring cannot be effectively assessed, and even the risk itself could remain unknown. However, adopting a sound risk management approach is still likely to have significant benefits.

The prioritization of risks is often linked to a geographical context. For natural hazards, risks can be associated with plate tectonics or subtropical convergence zones. For anthropogenic hazards, a lower level of economic development is usually associated with higher economic and geopolitical risks.

Step 3: Elaborate response and mitigation measures

Response and mitigation measures promoting preparedness and strengthen absorptive, responsive and adaptive capacities must be elaborated once risks have been identified and prioritized (Step 2); these measures must be introduced throughout a port’s infrastructure, processes and services (figure 20).

Figure 20: Step 3 – Elaboration of response and mitigation measures

Two fundamental and complementary resilience-building/risk mitigation and impact alleviation strategies can be considered: the first is a proactive strategy (involving pre-event and promoting preparedness and readiness in the face of disruptions); and the second is a reactive strategy (comprising post-event and promoting mitigation of impacts, recovery, and adaptation).

- Proactive or pre-event (preparedness and port risk management). This refers to risk management strategies that seek to identify, assess and mitigate risks, and address or mitigate risk before an event happens. It includes risk assessment, risk identification and vulnerability assessment. Physical asset or infrastructure preparedness focuses on the physical capabilities of the port, including infrastructure, superstructure, or any other physical assets that may be needed to mitigate an expected risk. Process and people preparedness focuses on a port’s managerial capabilities, including the services, management and human resources, required to mitigate an expected risk, including collaborative measures with stakeholders, such as carriers and infrastructure managers.

- Reactive or post-event (port crisis management, absorption of disruption and recovery). This refers to an event/disruption, as well as crisis mitigation strategies aimed at responding to a crisis (a risk event) immediately after it has taken place, and which seek to reduce their negative impacts. Infrastructure response and adaptation focuses on the required infrastructure, superstructure, or the physical assets necessary to absorb the disruption, restore pre-existing conditions, or recover or bring them to a similar level, while at the same time as ensuring continuing growth. This mainly concerns repairs. Process response and adaptation focus on the required managerial and human resources to be mobilized to absorb the disruption, restore the pre-existing conditions or bring them to a similar level, recover from the disruption, and continue to grow. This mainly concerns operational adjustments, communications, collaboration and financial disbursements.

Port risk management and port event/disruption, or crisis management, can be implemented jointly or independently, depending on the risk. Adopting a proactive approach through pre-event preparedness could be judged as being too costly as some risks are unlikely to occur in some ports. In these circumstances, it may be more relevant to have a reactive approach or post-event response targeting specific risks, while concurrently maintaining the appropriate infrastructure and managerial capabilities.

An overview of the key elements forming part of a proactive (i.e. pre-event preparedness and state of readiness) and reactive (i.e. post-event response and mitigation) approaches to risk management and resilience building are presented below and featured in figure 21:

- Risk management includes the identification and assessment of potential impacts (e.g. enterprise risk management, risk registers, risk metrics).

- Crisis management (protocols).

- Improving infrastructure and Improving superstructure.

- Improving processes and operational efficiency.

- Satellite facilities.

- Traffic diversion and multi-sourcing (given third party supplier risks).

- Preparedness (pre-event focusing on preparing infrastructure and equipment, as well as processes such as business continuity plans)

- Hazmat reporting.

- Cyber-resilience.

- Training, awareness-raising, and building required skills among the labour force.

Figure 21: Key mitigation and response measures to port disruptions

Step 4: Prioritize response and mitigation measures and allocate resources

Once mitigation and response measures have been elaborated (Step 3), each measure must be prioritized and the resources required for its implementation needs to be assessed, earmarked and mobilized (figure 22). When assigning an order of priority to the various response options and mitigation measures, it is important to distinguish between critical measures which could have dire consequences if left unaddressed, from those that are relevant but not essential. Their absence would not be detrimental to the port and its ability to cope and recover from the disruption.

Figure 22: Step 4 – Prioritization of response and mitigation measures and resource allocation

The investments required for port infrastructure and superstructures are determined according to risks which can be ranked and prioritized. Cost-effectiveness analysis, stakeholder analysis and multi-criteria analysis are among a range of methods that can be used to conduct an economic valuation. Setting priorities or establishing a sequence of measures should be based on criteria, such as past experiences or current strategies being implemented by similar ports, as well as take into consideration other factors, such as affordability and the technical feasibility. Measures can be evaluated using a cost-benefit analysis to weigh the potential benefits of a response option or mitigation measure against its expected costs. Prioritization involves four fundamental issues:

- Cost of inaction. The default position concerning risk, and accompanying mitigation and response measures, could be to not take any tangible actions, particularly if the risk is not clearly identified, is of low probability, and requires expensive response and mitigation action. Inaction can appear to be an attractive proposition, and a conclusion may be reached that no resource allocation is required. This could also be related to the expectation that the costs associated with a disruptive event will, in part, be assumed by a third party, such as a terminal operator (e.g. it will need to clear any liability it may have), an insurer (with respect to coverage), or government entities (in the case of disaster relief).

- Proactive versus reactive. Each hazard risk can be mitigated, and its impacts alleviated proactively and reactively. Proactive measures (pre-event that promote preparedness and prevention) tend to be more expensive than reactive measures (post-event and focus on mitigating immediate impacts and concerns). Since most hazard events cannot be predicted accurately (unreliable risk assessment), reactive measures can be perceived to make more sense from a cost/benefit perspective.

- “Low hanging fruit”. This usually involves a mitigation and response initiative that stands out from a cost/benefit perspective rather than more complex and expensive measures. In recent years, cybersecurity issues have emerged as one of the most salient risks to ports; this issue can be proactively mitigated, and its impact alleviated with a pre-event implementation of up-to-date software and staff training to avoid common threats, e.g. “fishing” emails containing malware. Paradoxically, a reactive post-event approach to cybersecurity can be much more costly.

- Opportunity cost. The time and resources allocated to risk mitigation (identification, potential impact assessment, and management), preparedness (pre-event measures), and response (post-event action and measures) is usually at the expense of other priorities and considerations. For example, the resources earmarked to increase port resilience against potential hazards could have been spent on expanding infrastructure, buying equipment, improving port marketing, or paying off a debt.

Each response and mitigation measure requires allocating often scarce resources, or constrained by other competing demands on the budget:

- Financial resources need to be earmarked to implement response and mitigation measures that have been prioritized and elaborated. Where will the funding come from? Can the port revenues and financial resources sustain the expenditure? Does it require contracting debt, such as issuing bonds? Are there grants available from national or international agencies?

- Managerial resources. These will be required to provide overall guidance and oversight when elaborating, implementing, monitoring, reporting and reviewing the effectiveness of response and mitigation measures deployed.

- Labor resources. A skilled workforce will be required to elaborate, implement, monitor, report and review the effectiveness of any response and mitigation measures that may have been deployed. For smaller ports, particularly in developing countries, know-how, technical knowledge, expertise and technology are particularly important as these are less ubiquitous.

Step 5: Implement, monitor and review

The implementation phase immediately follows Step 4 and focuses on prioritizing response and mitigation measures and allocating resources accordingly.

Figure 23: Step 5 – Implementation, monitoring and review

The deployment and implementation of response and mitigation measures can face a variety of opportunities and obstacles (figure 23):

- Financial. Challenges may constrain the capacity to fund and pay for a resilience strategy. First, there could be financial opportunities, such as programmes, subsidies and tax abatements supporting resilience initiatives. Funds may only be partially available, or stakeholders with committed funds (e.g. a government agency) may delay, modify or rescind their commitment. Furthermore, response and mitigation measures could turn out to be more expensive than expected due to improper cost assessment, thereby impairing their implementation.

- Technological. This includes challenges relating to the implementation of infrastructure and superstructure remediation. New technologies commonly offer opportunities to invest in more resilient systems. Improved technologies often come with lower costs (acquisition and operations), and make it possible for ports with less financial capabilities to make such investments. However, the response and mitigation measures may be more technically complex to implement than expected, and the availability and capability of a technical fix could be overestimated. This is often referred to as the hype-cycle, i.e. the exaggeration of the capabilities of a new technology, leading to its abandonment and deferred implementation.

- Footprint. The physical capacity of some ports can hamper its capacity to implement needed mitigation. A port with access to additional land, including through reclamation, is presented with an opportunity to redesign some of its infrastructures and operations. This is also the case when a new terminal is constructed. Response and mitigation measures may create additional demands on the physical footprint available for port operations, as well as impair port activities, and compete with other uses. A port may not have a suitable amount of land to implement response and mitigation measures, which could restrict future expansion opportunities.

- Administrative. From a behavioural perspective, this challenges a port’s managerial capacity to recognize the need for and subsequent design, implementation, monitoring and review of its resilience strategies. Policy changes present an opportunity for port governance and management to adapt; however, a port’s governance structure may not be suitable to implement response and mitigation measures. A change in governance, such as new leadership, may create incentives to explore new approaches, and new roles and functions will need to be defined and adequate personnel recruited or trained.

- Regulatory. Challenges to the conditions and legality of resilience initiatives. Approval must be obtained from regulatory agencies when a port authority or terminal operator does not have the jurisdiction, or approval for implementing response and mitigation measures; obtaining this approval would take time, and require administrative and legal resources. Environmental impact assessments and reviews are among the most complex regulatory burdens faced by ports.

- Commercial. Challenges to remain competitive and satisfy the needs of its users and customers. The response and mitigation measures may impact port competition and its ability to attract or retain customers. It could impose additional costs or create changes in port operations that do not entirely meet customer expectations. However, port resilience strategies can lead to new commercial opportunities and attract customers.

Some response and mitigation measures can face complex obstacles which only become apparent in the latter stages of implementation (Kim, Y., and L. Ross, 2019).

- Inertia in business models. As a business, ports prioritize cost control, and focus on revenue. Port planning cycles usually have a 5 to 10-year horizon, and the life span of infrastructure is 30 to 50 years. Long-term leases make capital investment an essential risk for port development; all the while, other considerations, e.g. resilience, may be sidelined.

- Digitalization of business models. Automation and digitalization present opportunities to improve port resilience and risks.

- Unfamiliar business models. Ports require a better understanding of how resilience can enhance operational performance, profitability and competitiveness. As landlords, port authorities are reluctant to integrate resilience requirements in concessions and operational requirements as they may reduce the willingness of international terminal operators to bid for a concession.

- Lack of risk data and guidelines. Several risks are difficult to quantify and appraise in a suitable manner for decision-making. The lack of information and data on hazards, such as climate change makes them difficult to include in port planning and operations. Only well-defined risks could be enforceable. Furthermore, long-term risk data is lacking and not available in a manner that can inform planning and investment decisions.

- Lack of definitions and metrics. There is a lack of definitions and metrics challenges for resilience considerations in port investment projects from governments, lenders and investors. The concept of resilient investment remains elusive and potentially compromises the obtention of better financial and capital terms for more resilient projects.

- Lack of standards for design and engineering. Concepts and goals on resilience need to be translated into practical design and engineering standards for port infrastructure and superstructure. Hardening and threshold factors are mainly assumptions that can only be confirmed once disruption occurs.

- Limited incentives for proactive actors. Port and terminal operators may not see the benefits of proactively minimizing their risks, as costs are visible and benefits may be intangible. In addition, the insurance industry does not price resilience effectively; an improvement in insurance price differentials could become an incentive mechanism.

The timeframe is an integral part of the deployment and implementation of response and mitigation measures. The timeframe determines whether a resilience-building strategy will take place before (proactive and pre-event), or after an event (reactive and post-event). Preparedness, response and mitigation measures that require investing in infrastructure and equipment will take more time than process or management-related measures. Four types of implementation or deployment timeframes can be distinguished:

- Short-term/immediate implementation. Measures that can rapidly implemented tend to be process-related or managerial, e.g. changes in managerial roles, new or upgraded software, training seminars, or the preparation of a business continuity plan (BCP).

- Within a year. The purchase of equipment and minor infrastructure improvements, e.g. IT upgrades and parts for maintenance and repair.

- Within three years. Significant infrastructure improvements, e.g. yard renovation and the acquisition of cranes.

- More than three years. Major port infrastructure projects, including yard expansion and hinterland connectivity (e.g. road construction, rail spurs and channel dredging).

Implementation delays are a common issue, and usually the outcome of obstacles, some of whom were underestimated or unforeseen. For instance, the dredging and expansion of the Elbe channel connecting the port of Hamburg to the North Sea was delayed by litigation for several years. Before becoming entangled in regulatory issues, the medium-term mitigation was projected to take about three years, but after litigation it was delayed by about five years.

A review phase can occur after a disruptive event and represents an opportunity to evaluate the effectiveness of a response, or a mitigation strategy and, if necessary, a subsequent revision. Success stories can become part of a port’s promotional literature and evidence for other ports to learn from best practices. Failures, or ineffective strategies, should not be discarded but rather serve as valuable lessons.

Resilience strategies entail a trade-off between the potential risk of disruption and the cost of mitigating the risk and responding/mitigating its impact should it materialize. A fundamental issue is that each resilience-building strategy usually comes with an additional cost that must be shouldered by the stakeholders involved, particularly port users (e.g. carriers). A higher cost structure will ultimately be reflected in the final price paid by consumers, unless improvements in resilience are also associated with productivity improvement. These costs should be balanced against the benefits of reducing the likelihood, or impact of a disruption event.