Event: COVID-19 pandemic, 2020-2022

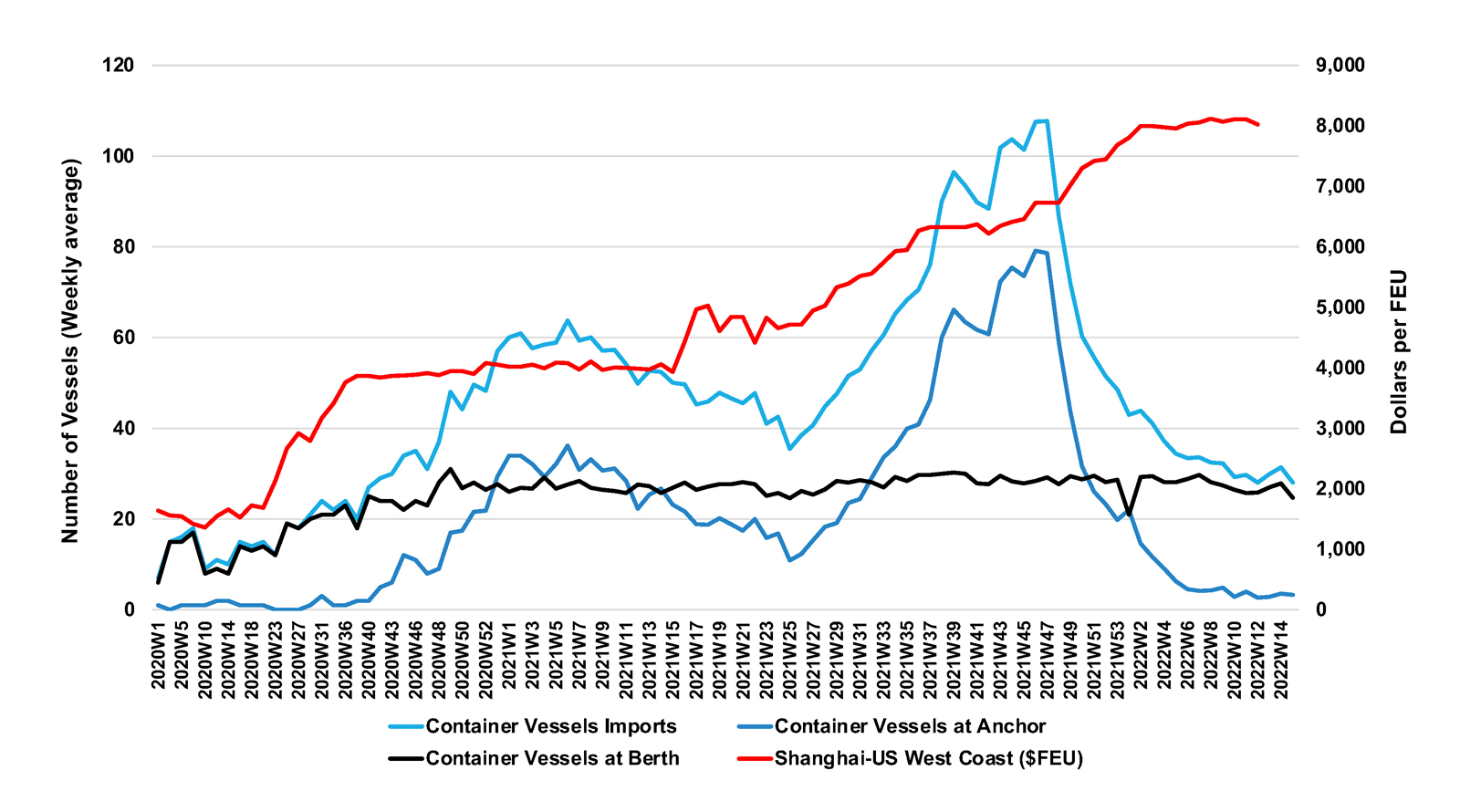

Since the onset of the COVID-19 pandemic in 2020, the ports of Los Angeles and Long Beach have faced severe disruption. From mid-2021, the ports experienced massive logjams of container vessels at anchor, with an average of 30 vessels waiting at any given time (figure 40). The crisis abated slightly between mid-April and the end of July 2021 when the average number of vessels anchored dropped to about ten. In August 2021, this number surged to record levels (60-80 vessels) as congestion resumed, mainly due to the peak import season of the late summer and early Autumn. By the first half 2022, there were signs of a material easing of the congestion and a drop in the average number of days during which vessels remained anchored.5

Figure 40: Containerships inside 25 Miles of Los Angeles/Long Beach (weekly average), 2020–2022

Source: Marine Exchange of Southern California. Freight rates data based on Clarkson Research 2022.

The associated decline in the velocity of containers due to port congestion and the unavailability of containers and chassis compounded propagation and led to a global shortage of containers (Henry P., 2021). Relatively small increases in the traffic resulted in a disproportionate decline in the velocity of containers, resulting in additional rate surges. Workforce shortages and the capacity of inland transport systems, including rail and drayage, also played a significant backpropagation effect. The repositioning of empty containers back to Asia – a priority for shipping lines – had a negative impact on exports.

Causes and impact

The disruptive nature of the COVID-19 pandemic is the main factor behind the congestion that occurred in the Port of Los Angeles. The backlog of ships beginning in mid-October 2020 was amplified by: (i) large fluctuations in import demand supported by stimulus policies which boosted imports and e-commerce demand (Goodman J., 2021); (ii) a rush to replenish stocks and meet demand peaks, reflecting seasonal trends in American retail cycles; (iii) a shortage of skilled employees at the port complex and its hinterland induced by the pandemic and related restrictions (Foroohar R., 2021); (iv) limited spare structural capacity at container terminals; and (v) hinterland bottlenecks with limited railway connections and no-short-sea shipping options (Kundu A., 2021).

With San Pedro Bay handling 40 per cent of the American containerized traffic, the impact on global supply chains progressively cascaded, with ripple effects on next-destination ports and interconnected transport modes. Peak activity period is usually between August and November, and the period of low activity is between January and March. Delays in delivery times were observed across the board. Cost increases, rate increases, extended delays along supply chains, canceled port calls, mostly in developing economies, and goods shortages have also been reported. There was also a negative environmental impact and air quality degradation/pollution due to emissions in port areas. Ships at anchor damaged a pipeline and caused a large oil spill. Subsequently, calls were made for greater regulatory oversight of container shipping and their pricing practices.

Response and mitigation measures6

- Expanded port operations hours; strengthened port cooperation (Brunton L., 2021).

- Raised the container stacking height limit on facilities outside the port

- Large cargo owners chartered their own ships to move goods across the Pacific.

- Government legislation aimed at investing in transport infrastructures, including ports, roads and railroads (Peterson E., 2021).

- Regulatory intervention to ensure fair and transparent shipping practices and rate/charge setting.

- Incentives and deterrents were put in place to reduce the dwelling of containers at port terminals.

Lessons learned and good practice

- Aligning hinterland capacity with port capacity and demand peaks can help minimize congestion. This may involve improving short-line rail infrastructure and rail service to the port and promoting collaboration between the public and the private sector owning the rail infrastructure.

- Short-sea services should be considered, as deemed appropriate and applicable, to enhance hinterland connectivity.

- Additional warehousing capacity should be developed to help solve inland congestion and lack of storage space.

- Speeding up the flow of containers and chassis may help to avoid extended dwell times and inefficiencies. For example, apart from providing incentives and deterrents, ports and ocean carriers can agree on a joint strategy to deal with empty containers and ensure their availability to exporters.

- Efforts should aim to enable digitally facilitated real-time coordination between port and hinterland operators.