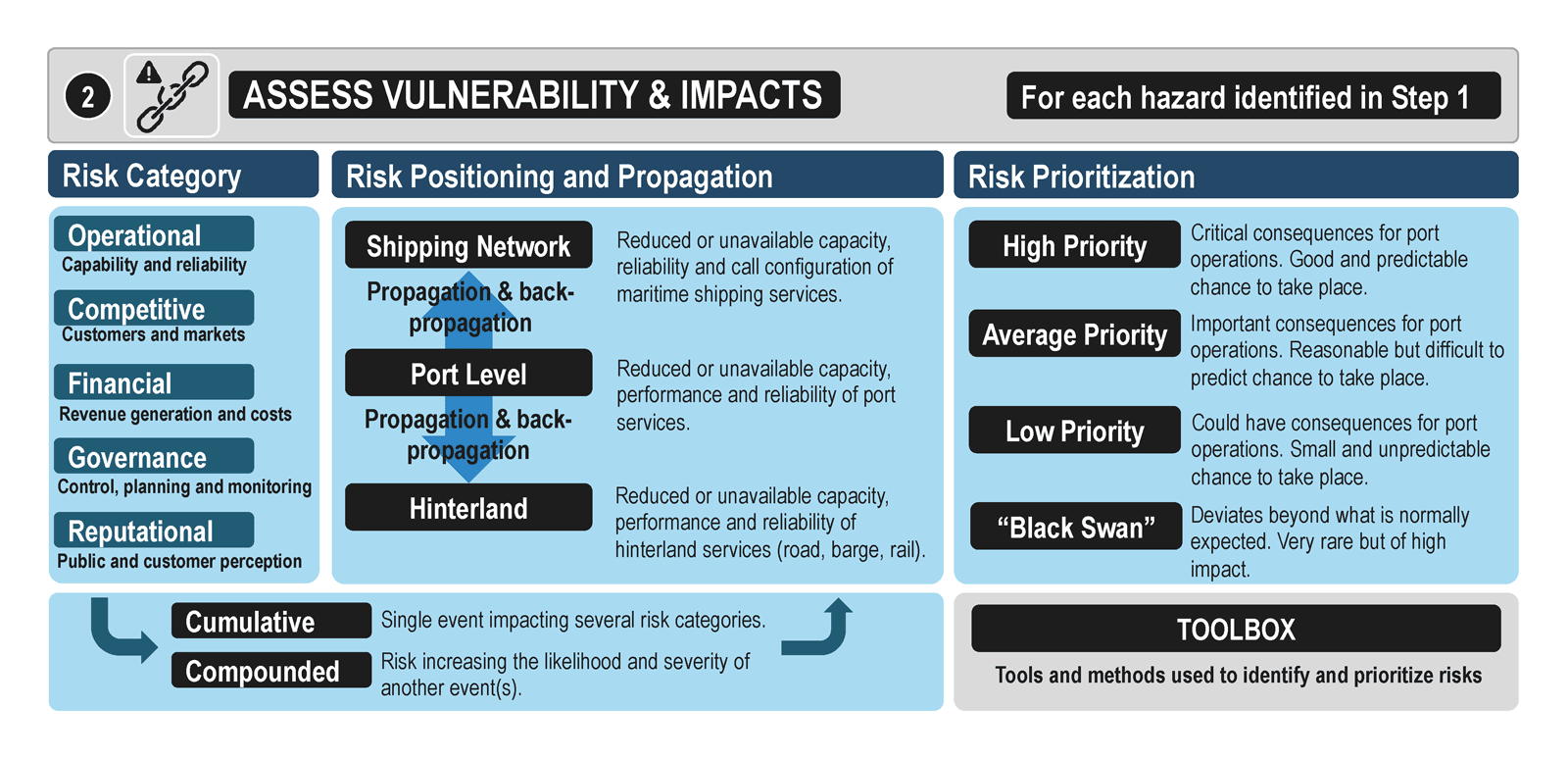

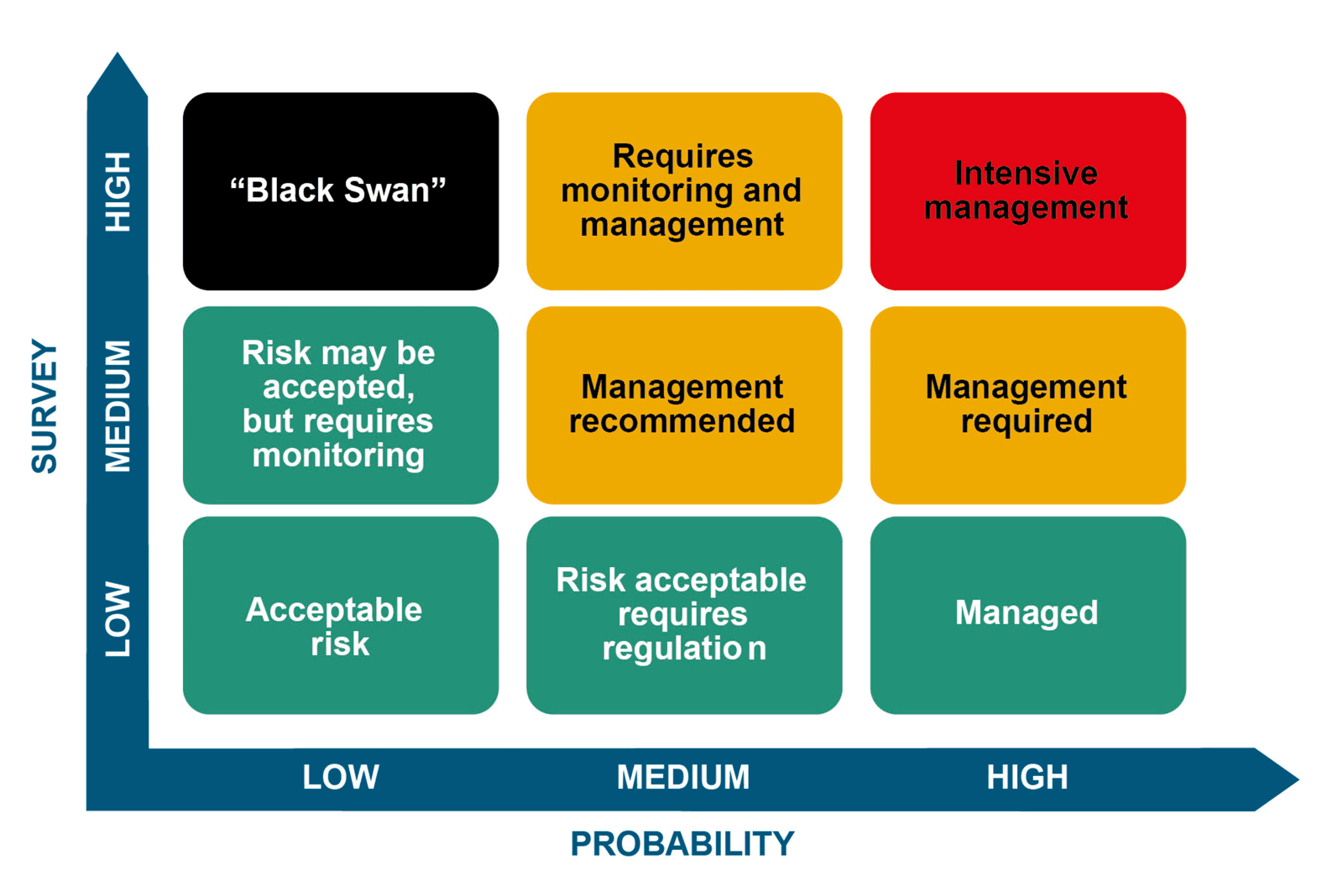

Once a list of the most important hazards potentially impacting a port has been established (see Step 1), the second step involves their categorization as risks. An explanation of the type and scope of the risk category needs to be provided, as well as their features, how they can occur and affect ports, and their resilience and the likelihood a disruption may occur (figure 15). Risks can be quantified using the risk=probability x severity method (figure 16).

Figure 15: Step 2 – Assessment of port vulnerability and potential impacts

Figure 16: Quantifying risks

Source: Adapted from Manners-Bell J. (2022).

Each hazard that may impact a port has an associated risk category. While the list identified in Figure 15 is not exhaustive, it nonetheless reflects the various types of risks often associated with port disruptions. These include:

- Operational risks. To what extent does the hazard impact a port’s or terminal’s capacity to operate and offer services to ships, cargoes and other clients (e.g. clusters or activities in the proximity of the port). These indirectly impact global value chains which may be heavily dependent on well-functioning shipping and ports.

- Competitive risks. To what extent does the hazard impact a port’s or terminal’s competitiveness vis-à-vis its customers (e.g. shipping lines, cargo owners), and hinterland stakeholders.

- Financial risks. To what extent does the hazard impact a port’s or terminal’s revenue, operating costs, insurance rates and credit rating.

- Governance risks. To what extent does the hazard impact a port’s or terminal’s management and planning processes.

- Reputational risks. To what extent does the hazard impact a port’s or terminal’s public image, standing and customer perception.

These risks are cumulative, meaning that a single event could not only disrupt operations but also: (i) create reputational risks; (ii) generate a loss of business and revenue to the benefit of other ports or modes of transport; (iii) cause delays and congestion; (iv) labour shortages; or (v) result in a lack of storage areas.

Several risks are interconnected, with compound risks defined as risks that are non-independent. The compounding effects of one or more other risks could influence the probability and the severity of any other individual risk. For example, equipment failure can increase the risk of additional equipment failure as functioning equipment can become overburdened. A cyber-attack could impact IT systems related to payroll and equipment, compounding its deleterious effect across terminal operations. Furthermore, more than one hazard can occur at once, and exacerbate the situation. For example, a port could be simultaneously impacted by a pandemic or a seasonal hurricane, while concurrently facing a labour shortage due to pandemic-related restrictions and constrained financial capacity.

The consequence of any given event could be greater than the sum of each individual risk. Since the maritime transport system is organized as an interconnected network, with ports as core nodes, the compounding effects of risks serve as propagation and back-propagation mechanisms. Risk positioning and propagation considers which elements of the maritime transportation chain may be impacted first, and how the disruption may propagate (or back-propagate) along the transport chain. This mechanism illustrates the compounding effect of risks in the maritime industry:

- Shipping network. The risks involved in a shipping network can lead to changes in – or to a reduction in or lack of – ships carrying to ship services capacity, shipping service reliability, or schedule reliability. The ship call configuration of maritime shipping services can also be modified, dropping a port, and reducing the frequency of port calls. Excess capacity can also be a risk, since it could result in the removal of shipping services and ports of call, thereby impacting the frequency of procurement for port-centric supply chains.

- Port level. Any change in risks – or to a reduction in or lack of – can affect the performance, reliability and costs of port services. As in the case of shipping lines, excess capacity can also be a risk for ports as it is associated with lower returns on investments and excess labour, which could lead to layoffs and undermine revenue.

- Hinterland. Risks involving changes in capacity (i.e. a reduction in or lack thereof) can affect performance and the reliability of hinterland services, including trucking, rail and barges. Excess capacity risks are less common over hinterland transportation, but building unnecessary infrastructure or services is a risk as it may not provide a sufficient return on investment.

Understanding the potential disruptive propagation mechanisms along maritime transport chains is important. For instance, a labour strike at a port may impact its capability to meet expected key performance indicators (KPIs), but could back-propagate over the shipping network as ships could spend more time at the port (e.g. waiting at anchor), which then impacts their schedule integrity. In such situations, the performance of other connected ports is also impacted. The disruption could also propagate through the hinterland connectivity with longer gate waiting times and slower yard operations.

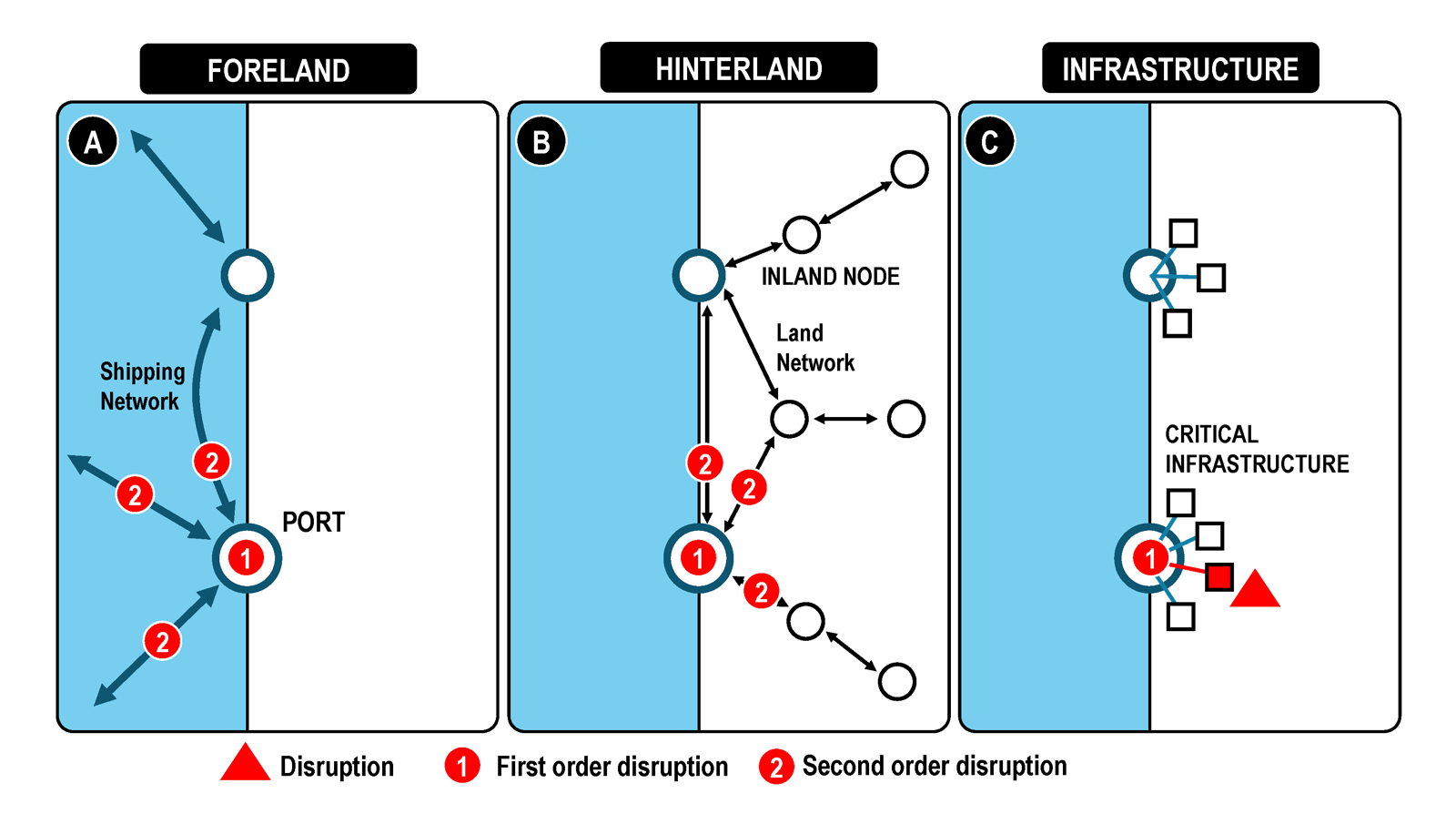

The disruption of a critical infrastructure asset can lead to a port experiencing a first-order disruption (figure 17, Layer C). As any affected port is connected to other assets, as well as foreland and hinterland connectivity (layers A and B), second-order disruptions occur through propagation. The capability of the port to handle hinterland traffic and shipping services is impacted until the first order disruption is resolved. For instance, a power outage in critical infrastructure servicing a port could create a first-order disruption and impair operations (e.g. by relying on generators). If long-lasting, this disruption will then propagate to become a second-order disruption, which in this case will impact the hinterland and maritime connectivity of the port. Ships could be forced to wait at anchor or diverted to another port.

Figure 17: Disruption propagation in a port network

Source: Adapted from Verschuur, J., R. Pant, E. Koks, et al (2022).

Once the vulnerabilities to each identified hazard are assessed as a risk, they can be ranked by levels of priority (risk prioritization). The lack of predictability limits the value of risk assessments for events with a low probability, but which could have severe consequences. Furthermore, any resilience strategy must include considerations on unknown risks (Black Swan events).

- High priority risk. A hazard that is identified as high risk and could have critical consequences for port operations, including stopping operations, and has a good and predictable likelihood to take place. Ports in areas where there is a recurring risk of high impact natural hazards, e.g. extreme weather events, such as hurricanes in the Caribbean and typhoons in East Asia, are giving high priority to these risks.

- Average priority risk. This covers hazards that have been identified as having an average risk of occurring, but which could have significant consequences for port operations (e.g. disrupting operations) should they occur; these hazards are considered to have a reasonable but difficult to predict likelihood of taking place. Information technologies are an emerging risk that could have a notable impact on port operations in the event of a successful cyber-attack.

- Low priority risk. Hazards identified as having a low and unpredictable risk of occurring could have consequences for port operations and marginally disrupt operations. Accidents and equipment failures are usually disruptive but tend to have a limited impact.

- Unknown risk (Black Swan events). A hazard identified as a risk that deviates beyond what is normally expected, and which is extremely difficult to predict. These events are very rare, but their impacts can be substantial when they occur. This is the reason why they are usually referred to as “crises”. While not “Black Swan” events per se, the COVID-19 pandemic and the financial crisis of 2008-2009, however, are two notable examples of a risk beyond what is normally expected. Preparing for such risks is difficult since their likelihood of occurring cannot be effectively assessed, and even the risk itself could remain unknown. However, adopting a sound risk management approach is still likely to have significant benefits.

The prioritization of risks is often linked to a geographical context. For natural hazards, risks can be associated with plate tectonics or subtropical convergence zones. For anthropogenic hazards, a lower level of economic development is usually associated with higher economic and geopolitical risks.