The implementation phase immediately follows Step 4 and focuses on prioritizing response and mitigation measures and allocating resources accordingly.

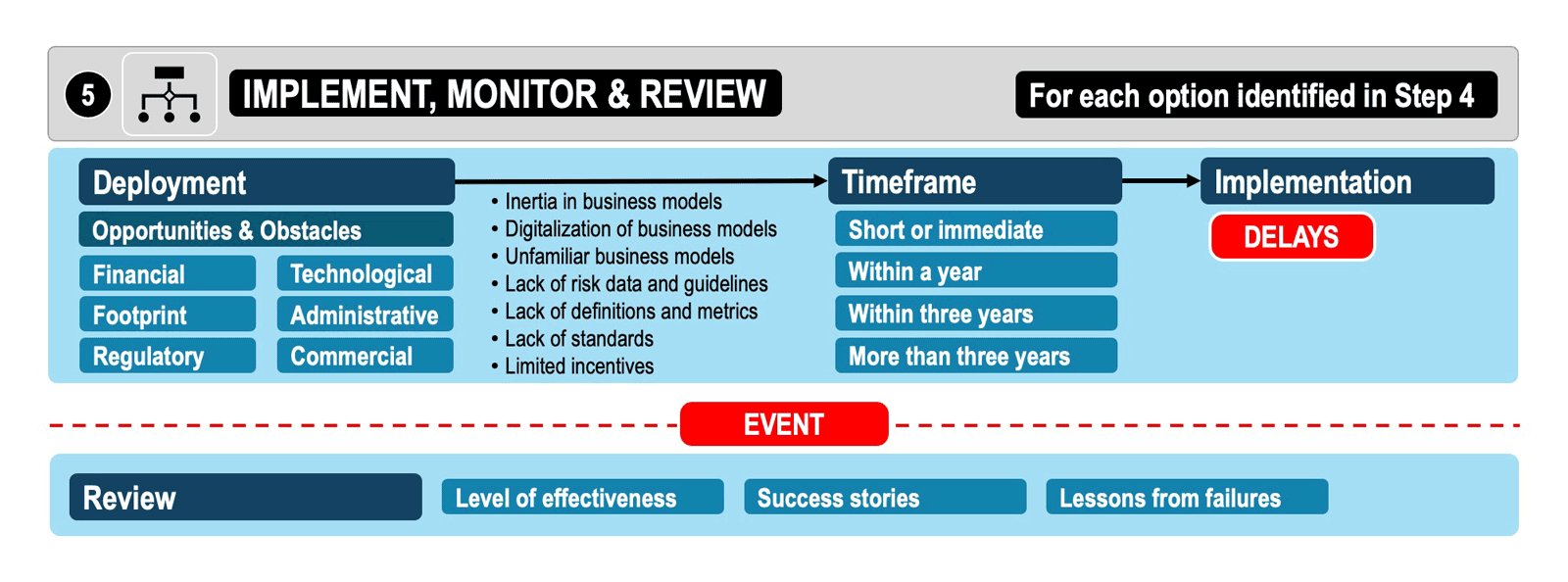

Figure 21: Step 5 – Implementation, monitoring and review

The deployment and implementation of response and mitigation measures can face a variety of opportunities and obstacles (figure 21):

- Financial. Challenges may constrain the capacity to fund and pay for a resilience strategy. First, there could be financial opportunities, such as programmes, subsidies and tax abatements supporting resilience initiatives. Funds may only be partially available, or stakeholders with committed funds (e.g. a government agency) may delay, modify or rescind their commitment. Furthermore, response and mitigation measures could turn out to be more expensive than expected due to improper cost assessment, thereby impairing their implementation.

- Technological. This includes challenges relating to the implementation of infrastructure and superstructure remediation. New technologies commonly offer opportunities to invest in more resilient systems. Improved technologies often come with lower costs (acquisition and operations), and make it possible for ports with less financial capabilities to make such investments. However, the response and mitigation measures may be more technically complex to implement than expected, and the availability and capability of a technical fix could be overestimated. This is often referred to as the hype-cycle, i.e. the exaggeration of the capabilities of a new technology, leading to its abandonment and deferred implementation.

- Footprint. The physical capacity of some ports can hamper its capacity to implement needed mitigation. A port with access to additional land, including through reclamation, is presented with an opportunity to redesign some of its infrastructures and operations. This is also the case when a new terminal is constructed. Response and mitigation measures may create additional demands on the physical footprint available for port operations, as well as impair port activities, and compete with other uses. A port may not have a suitable amount of land to implement response and mitigation measures, which could restrict future expansion opportunities.

- Administrative. From a behavioural perspective, this challenges a port’s managerial capacity to recognize the need for and subsequent design, implementation, monitoring and review of its resilience strategies. Policy changes present an opportunity for port governance and management to adapt; however, a port’s governance structure may not be suitable to implement response and mitigation measures. A change in governance, such as new leadership, may create incentives to explore new approaches, and new roles and functions will need to be defined and adequate personnel recruited or trained.

- Regulatory. Challenges to the conditions and legality of resilience initiatives. Approval must be obtained from regulatory agencies when a port authority or terminal operator does not have the jurisdiction, or approval for implementing response and mitigation measures; obtaining this approval would take time, and require administrative and legal resources. Environmental impact assessments and reviews are among the most complex regulatory burdens faced by ports.

- Commercial. Challenges to remain competitive and satisfy the needs of its users and customers. The response and mitigation measures may impact port competition and its ability to attract or retain customers. It could impose additional costs or create changes in port operations that do not entirely meet customer expectations. However, port resilience strategies can lead to new commercial opportunities and attract customers.

Some response and mitigation measures can face complex obstacles which only become apparent in the latter stages of implementation (Kim, Y., and L. Ross, 2019).

- Inertia in business models. As a business, ports prioritize cost control, and focus on revenue. Port planning cycles usually have a 5 to 10-year horizon, and the life span of infrastructure is 30 to 50 years. Long-term leases make capital investment an essential risk for port development; all the while, other considerations, e.g. resilience, may be sidelined.

- Digitalization of business models. Automation and digitalization present opportunities to improve port resilience and risks.

- Unfamiliar business models. Ports require a better understanding of how resilience can enhance operational performance, profitability and competitiveness. As landlords, port authorities are reluctant to integrate resilience requirements in concessions and operational requirements as they may reduce the willingness of international terminal operators to bid for a concession.

- Lack of risk data and guidelines. Several risks are difficult to quantify and appraise in a suitable manner for decision-making. The lack of information and data on hazards, such as climate change makes them difficult to include in port planning and operations. Only well-defined risks could be enforceable. Furthermore, long-term risk data is lacking and not available in a manner that can inform planning and investment decisions.

- Lack of definitions and metrics. There is a lack of definitions and metrics challenges for resilience considerations in port investment projects from governments, lenders and investors. The concept of resilient investment remains elusive and potentially compromises the ability to obtain better financial and capital terms for more resilient projects.

- Lack of standards for design and engineering. Concepts and goals on resilience need to be translated into practical design and engineering standards for port infrastructure and superstructure. Hardening and threshold factors are mainly assumptions that can only be confirmed once disruption occurs.

- Limited incentives for proactive actors. Port and terminal operators may not see the benefits of proactively minimizing their risks, as costs are visible and benefits may be intangible. In addition, the insurance industry does not price resilience effectively; an improvement in insurance price differentials could become an incentive mechanism.

The timeframe is an integral part of the deployment and implementation of response and mitigation measures. It determines whether a resilience-building strategy will take place before (proactive and pre-event), or after an event (reactive and post-event). Preparedness, response and mitigation measures that require investing in infrastructure and equipment will take more time than process or management-related measures.

Four types of implementation or deployment timeframes can be distinguished:

- Short-term/immediate implementation. Measures that can rapidly implemented tend to be process-related or managerial, e.g. changes in managerial roles, new or upgraded software, training seminars, or the preparation of a business continuity plan.

- Within a year. The purchase of equipment and minor infrastructure improvements, e.g. IT upgrades and parts for maintenance and repair.

- Within three years. Significant infrastructure improvements, e.g. yard renovation and the acquisition of cranes.

- More than three years. Major port infrastructure projects, including yard expansion and hinterland connectivity (e.g. road construction, rail spurs and channel dredging).

Implementation delays are a common issue, and usually the outcome of obstacles, some of whom were underestimated or unforeseen. For instance, the dredging and expansion of the Elbe channel connecting the port of Hamburg to the North Sea was delayed by litigation for several years. Before becoming entangled in regulatory issues, the medium-term mitigation was projected to take about three years, but after litigation it was delayed by about five years.

A review phase can occur after a disruptive event and represents an opportunity to evaluate the effectiveness of a response, or a mitigation strategy and, if necessary, a subsequent revision. Success stories can become part of a port’s promotional literature and evidence for other ports to learn from best practices. Failures, or ineffective strategies, should not be discarded but rather serve as valuable lessons.

Resilience strategies entail a trade-off between the potential risk of disruption and the cost of mitigating the risk and responding/mitigating its impact should it materialize. A fundamental issue is that each resilience-building strategy usually comes with an additional cost that must be shouldered by the stakeholders involved, particularly port users (e.g. carriers). A higher cost structure will ultimately be reflected in the final price paid by consumers, unless improvements in resilience are also associated with productivity improvement. These costs should be balanced against the benefits of reducing the likelihood, or impact of a disruption event.