Since the 1990s, globalization has enabled the expansion of international trade, as well as the outsourcing and offshoring of manufacturing. Over this time, maritime supply chains, which include shipping networks, ports and hinterland transport operations, have expanded, largely due to the growth of container shipping services.

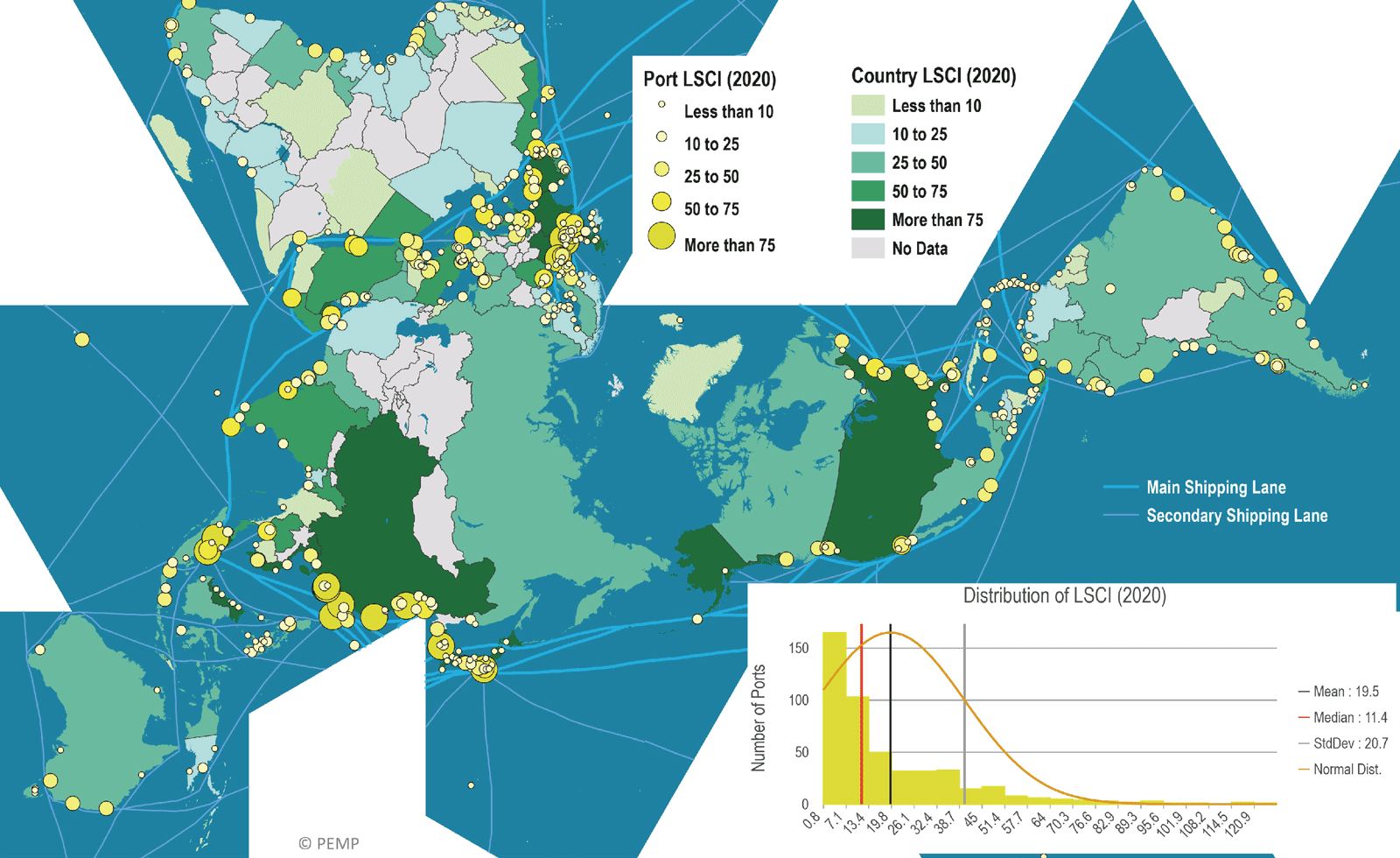

The configuration of the global liner shipping network can be represented through maritime connectivity, as measured by the Liner Shipping Connectivity Index (LSCI). It reveals a high concentration level among a small group of highly connected ports that act as gateways and hubs of global trade (figure 6). In 2020, 25 ports accounted for 17.7 per cent of the accumulated connectivity. Countries with the highest LSCI values are actively involved in international trade. The export-oriented economies of China and Hong Kong (China SAR), rank first, with the Singapore transshipment hub ranking third. Large traders, e.g. Japan, Germany, Republic of Korea, United Kingdom and United States, rank among the top 15. Countries such as Egypt, Malaysia, Oman, Spain, and the United Arab Emirates also rank high because of the major transshipment function of their ports. High concentration levels can expand the scale of disruptions, particularly when they involve ports or countries having high connectivity levels.

Figure 6: Maritime container shipping connectivity

Source: Based on data from MDST, https://www.mdst.co.uk.