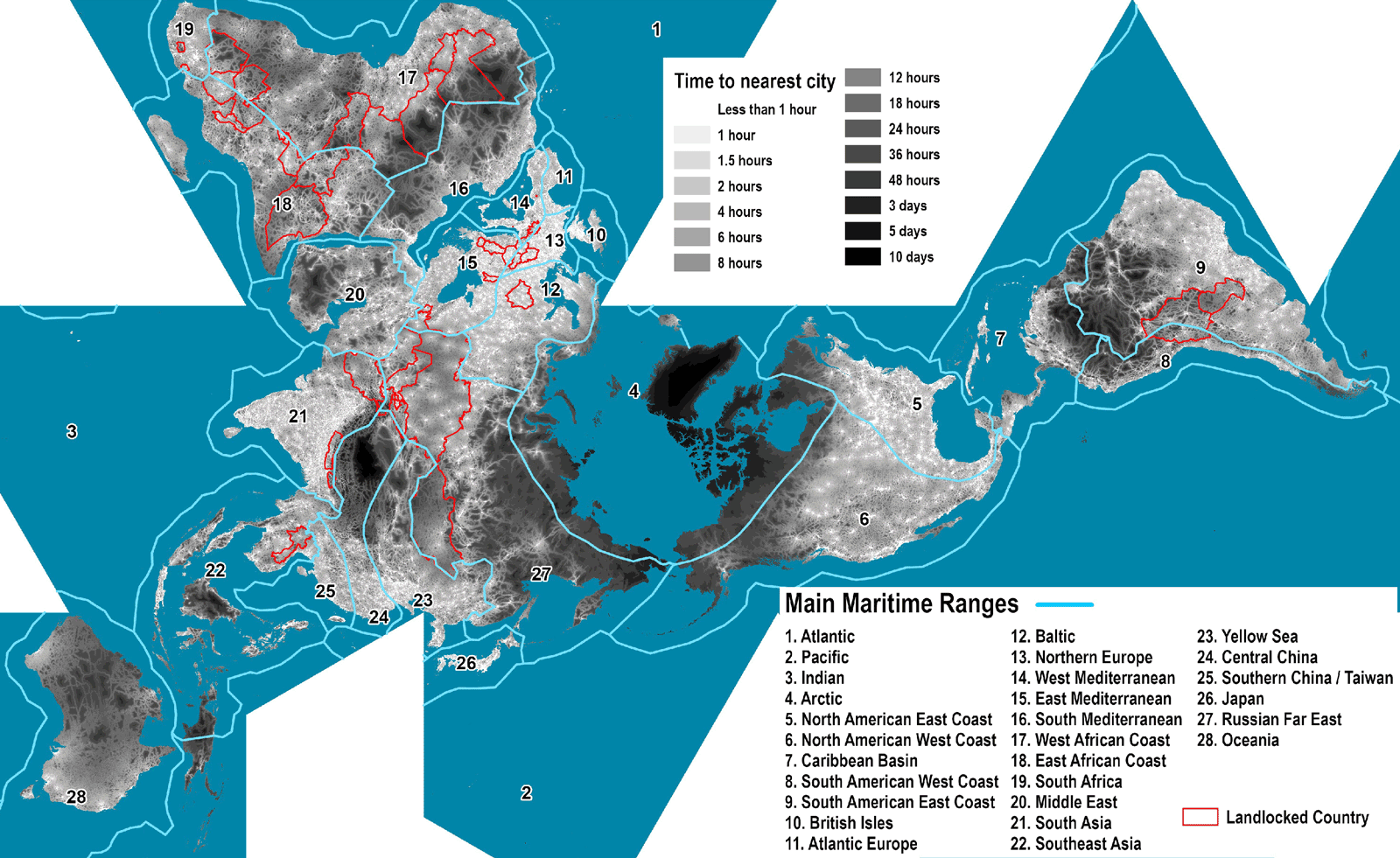

Maritime shipping services are commonly established to connect maritime ranges, which occasionally mark the extent of regional feeder services, such as the case in the Caribbean and the Baltic regions. Some maritime ranges and their hinterland have high levels of access levels, particularly when connected by high-capacity rail corridors, as in the case in the east and west coasts of North America (figure 8). Other maritime ranges are discontinuous and barely connected, as in the case of SIDS in the Caribbean, Pacific and Indian Ocean, or marginally connected, as in the east and west coasts of Africa.

For a given port, the hinterland contestability (i.e. the prospect for other ports to capture the cargo from/to the hinterland) affects its resilience. When a hinterland has a low or no contestability (i.e. not having more than one port option to route its cargo), it implies that the port handling trade from/to this hinterland, has access to a secure market base. This positively affects its resilience. However, such a port remains vulnerable to any significant downward change in demand.

Figure 8: Maritime ranges and hinterland accessibility

Source: Nelson A. (2008).

A hinterland (country) that does not have direct access to the ocean obliges it to use ports in a third country through a land (rail, road, internal waterways, or multimodal) corridor, and negotiating an access regime. This implies higher transport and trade costs impacting their economic competitiveness. If containerized imports are considered, landlocked countries have a cost structure that is about 85 per cent higher than the world average (World Bank, 2020). From a resilience perspective, these countries are particularly vulnerable because of the effects that higher transportation costs can have on their trade and costs (Box 1).

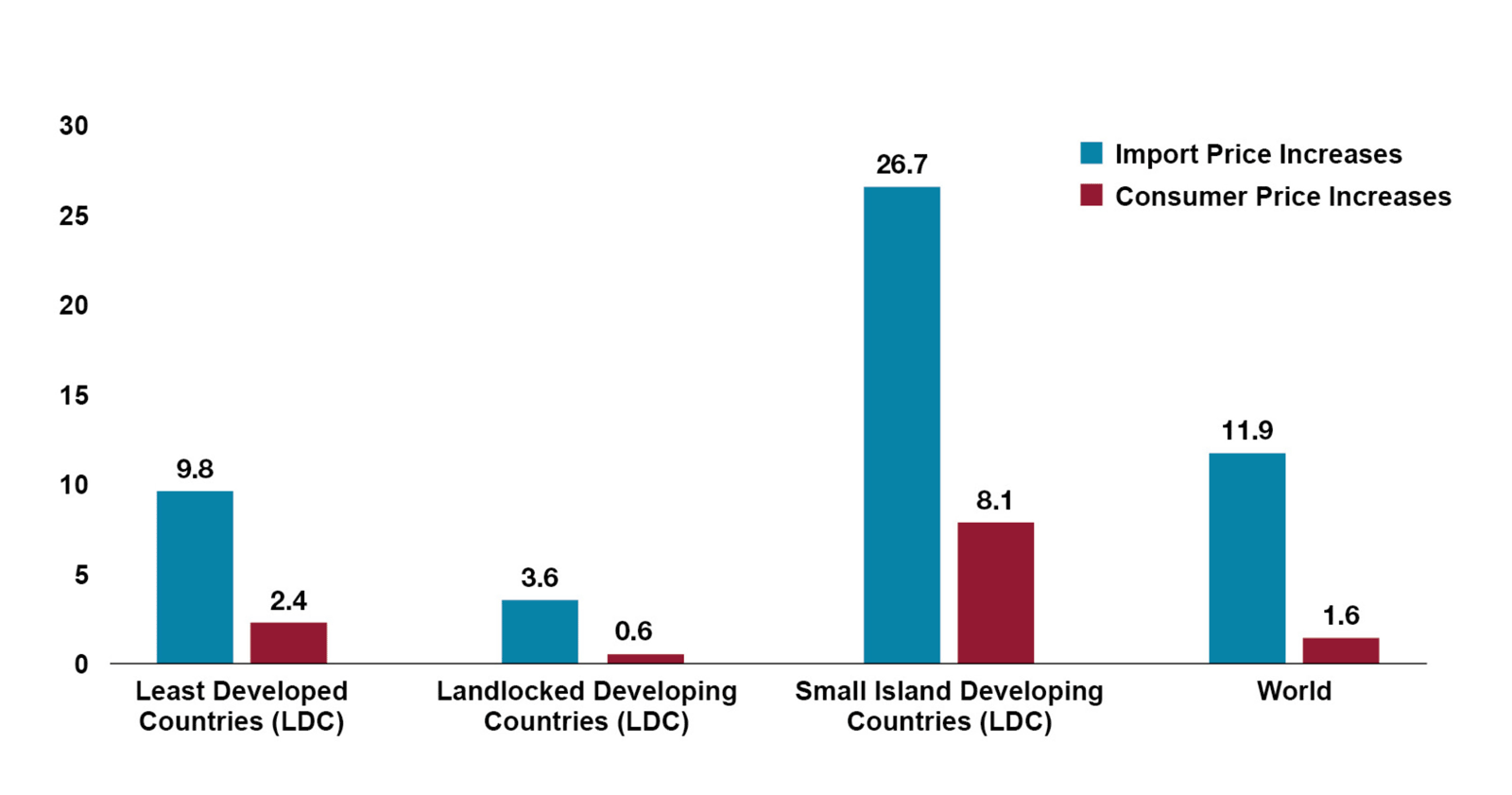

Box 1: Impact of freight rate surges on import and consumer prices

According to UNCTAD analysis, the surge in container freight rates caused by COVID-19 disruptions, if sustained, could increase global import price levels by nearly 12 per cent and consumer price levels by 1.6 per cent (figure 9). Demand for goods surged in the second half of 2020 and into 2021, as consumers spent their money on goods rather than services during pandemic lockdowns and restrictions. Working from home, online shopping, and increased computer sales placed unprecedented demand on supply chains. This large swing in containerized trade flows was met with supply-side capacity constraints, including container ship carrying capacity, container shortages, labour shortages, ongoing COVID-19 restrictions across port regions, and congestion at ports. This mismatch between surging demand and de facto reduced supply capacity led to record container freight rates on practically all container trade routes. Cargo owners faced delays, surcharges, and other costs, and still encountered difficulties in ensuring their containers were moved promptly. The impacts of the high freight charges are greater in SIDS, which could see import prices increase by 26.7 per cent and consumer prices by 8.1 per cent. In least developed countries (LDCs), consumer price and import price levels could increase by 2.4 per cent and 9.8 per cent, respectively. Low-value-added items produced in smaller economies could face serious erosion of their comparative advantages. A surge in container freight rates will add to production costs, rising consumer prices, and slowing national economies, particularly in SIDS and LDCs, where consumption and production are highly dependent on trade.

Figure 9: Simulated impact of soaring freight rates on consumer and import prices (Percentage change)

Source: UNCTAD (2021).