For decades, container shipping has been characterized by imbalanced trade patterns resulting in imbalanced container flows. This implies that about 20 per cent of the containers carried by maritime shipping are being repositioned empty. When COVID-19 lockdowns were being implemented in March 2020, the sudden drop in demand forced shipping lines to curtail capacity with blank sailings. Later in 2020, there was a surge in global demand as Chinese factories were brought back online. Demand patterns in North America and Europe subsequently shiftedtowards higher quantities of durable household goods.

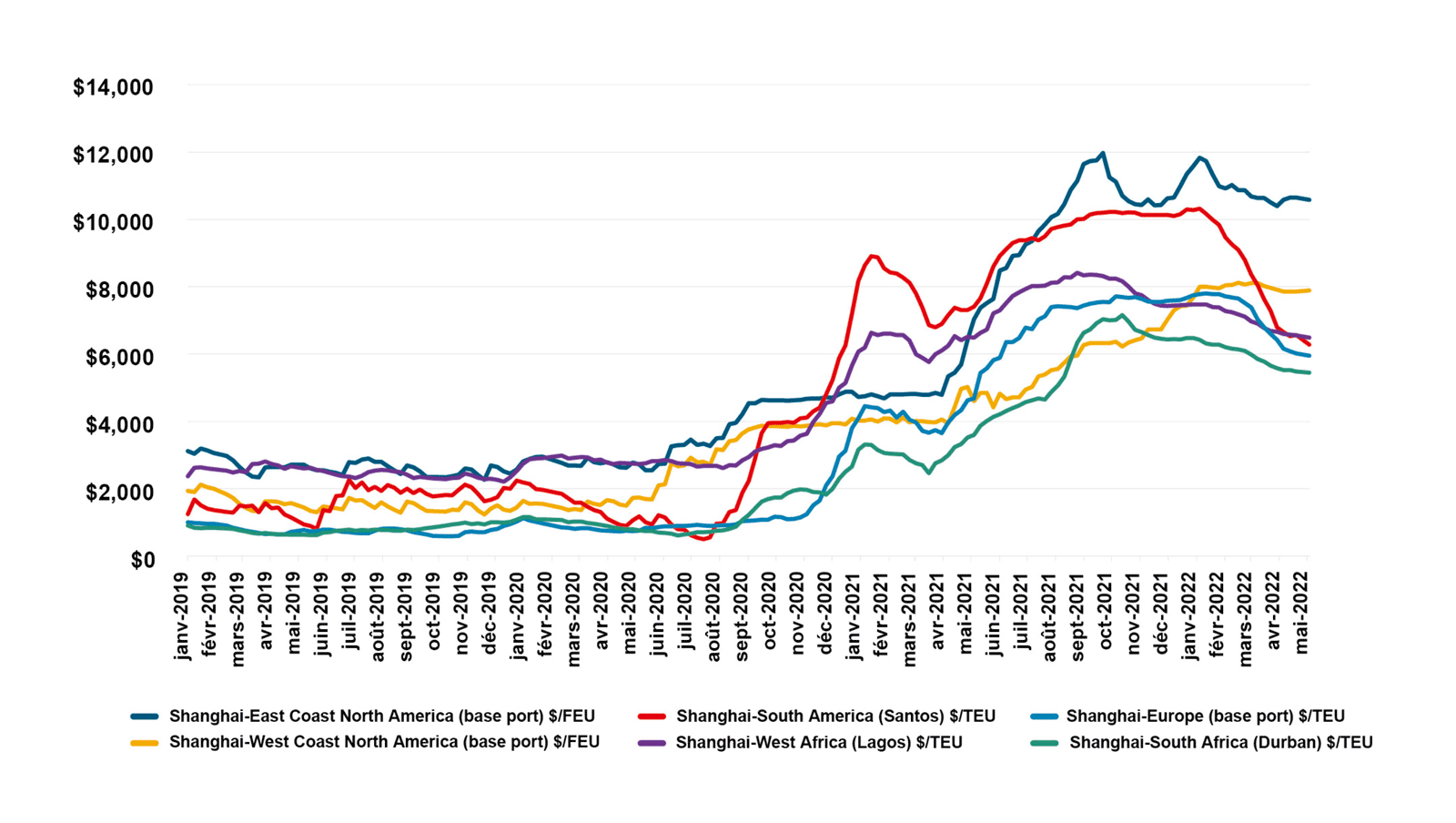

The shipping industry, which had curtailed capacity, was ill-prepared to keep up with the demand surge, and a delayed response. Even as shipping capacity was fully restored, a decline in velocity due to overshooting demand and port delays resulted in ship capacity shortages contributing to shipping rates surges and empty container shortages. Figure 38 underlines the stress that maritime shipping has absorbed across the main China/Europe/North America trade routes, in particular with rates surging since the second semester of 2020.

Figure 38: Container freight rates across major routes, 2019- 2022

Source: UNCTAD based on Clarkson Research data (2022).

Limited additional shipping and container capacity converged to incite a surge in container shipping rates to historical highs by mid-2021. Under normal circumstances, high shipping rates would provide a strong incentive to create additional capacity and remove marginal demand. However, about 50 per cent of all shipping contracts are long-term rates set below the spot rate, which are often offered to large customers, e.g. retailers, leaving large cargo owners to ship their cargo at a different (lower) rate. The sharp increase in shipping rates prompted shipping lines to renegotiate their contracts and set rates reflecting current market conditions.