A series of divergences between supply and demand was observed during the COVID-19 pandemic, placing maritime shipping and port operations under stress. In the initial stages of the pandemic in 2020, a reduction in demand was mitigated by capacity management in maritime shipping, such as blank sailings and dropping port calls. Shipping lines apply blank sailing or cancel a scheduled port call or a shipping service, mainly due to a lack of demand or to maintain schedule integrity.

The Global Supply Chain Pressure Index (GSCPI) surged in early 2020 and fell back in the Autumn of the same year as China resumed its manufacturing in the second semester of 2020. This return to normality created a divergence as the shipping and port industry could not cope with the surge across several trade lanes. An important driver was a shift in consumption patterns in key import markets, particularly in the United States. While consumers usually spend about 69 per cent of their personal consumption expenditures on services, the pandemic resulted in a drop to around 65 per cent by the second half of 2020, the extra spending going on goods consumption, notably durable goods. This shift was substantial enough to put significant pressure on supply chains. By late 2020, increasing port congestion resulted in the GSCPI surging again, particularly for Los Angeles/Long Beach – a surge aggravated by the blockage of the Suez Canal in March 2021.

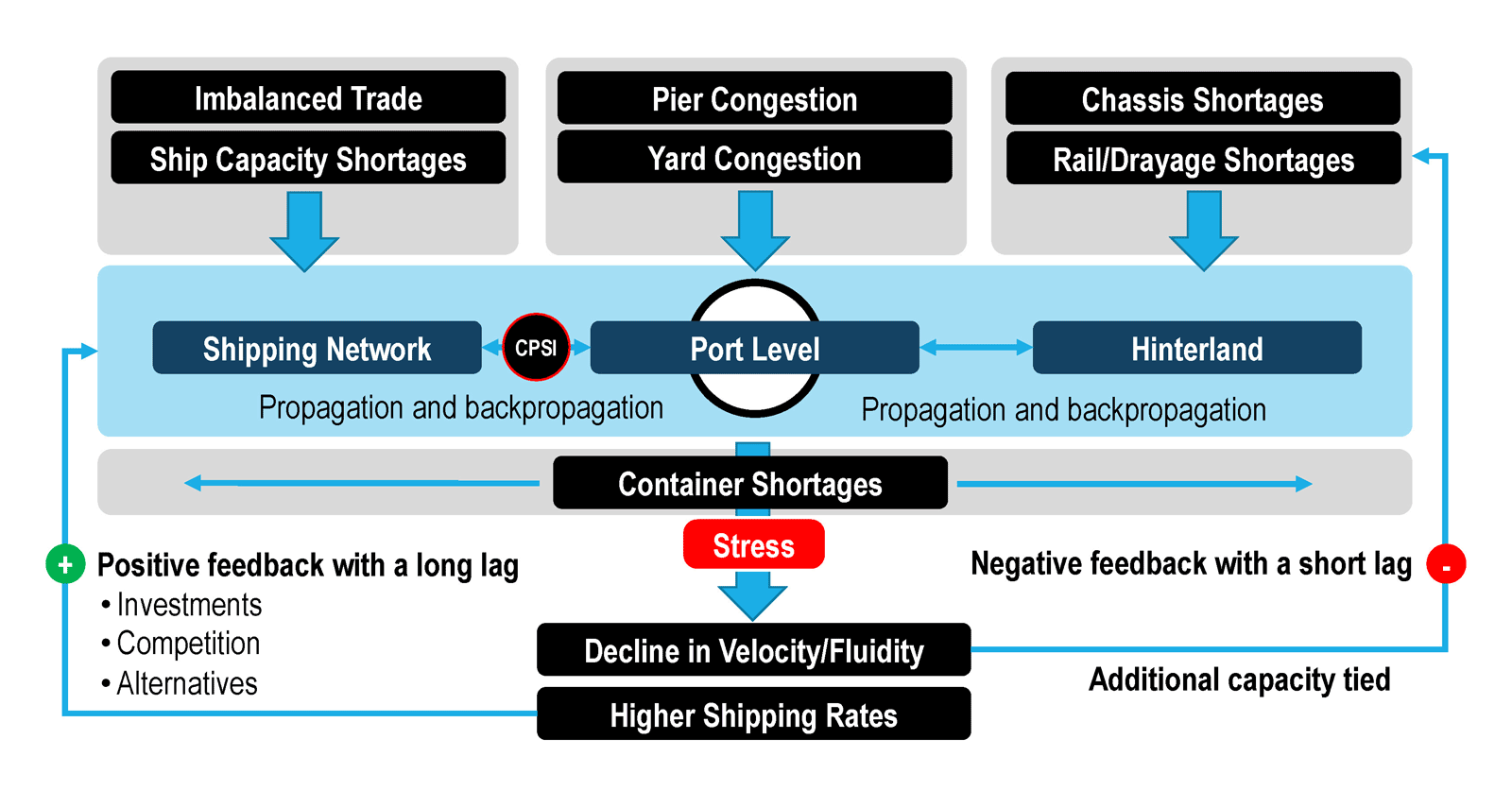

The COVID-19 pandemic underlined the crucial importance of maritime shipping as a divergence took place between passenger and freight transport systems. For the port industry, the pandemic created a "perfect storm" of unforeseen consequences in a far-ranging array of sectors. In contrast to conventional disruption in supply and transport chains, the event was global in scope, lasted more than two years, and comprised a series of waves and associated disruptions across multiple components, such as demand patterns, manufacturing, maritime and terminal operations and freight distribution. In the port and maritime shipping industry, a series of COVID-19-induced vertical and lateral impacts took place, particularly in the second semester of 2020. A series of propagation and backpropagation mechanisms were set in motion with compounding effects. These were felt differently across the main elements of the maritime shipping system (figure 37).

Figure 37: Vertical and lateral impacts of disruptions in maritime shipping during the Covid-19 pandemic

The stress related to the decline in the velocity of container movements gave rise to a negative feedback loop occurring over a short time lag. As containers had to spend more time being carried at terminals or inland due to a lack of capacity, whole elements of the transport chain had a reduced velocity and fluidity. More assets were then required to perform the same level of service, which further exacerbated congestion. If a container yard is congested, it restrains a terminal’s capacity to handle ships as they cannot be unloaded due to a lack of yard space. Starting in late 2020 until 2022, the case of Los Angeles/Long Beach is illustrative of these mechanisms at play (See Case Study).

The stress imposed on the shipping capacity resulted in a market response through higher rates, providing a positive feedback loop that will take more time to realize (i.e. month or years). These lagging effects, some of which have yet to materialize, include:

- Improved added value of the shipping and logistics sectors, leading to better profitability, visibility, capital investment and wages. The COVID-19 pandemic underlined the strategic importance of global supply chains with ports as key nodes. Disruptions were associated with higher rates, resulting in increased profitability for several key ports and maritime shipping lines.

- Increased competition and innovation in modes, terminals, distribution centres, processes and ITs. This could involve new entrants with substantial financial capabilities making the strategic decision to invest in own-account maritime shipping. Large retailers, such as Costco, are now chartering ships to transport containers between Asia and North America, and account for 20 per cent of the volume they generate. The purpose is to allow transportation and port infrastructure to continue to maintain a level of service that is better able to handle disruptions.

- More resilient supply chains will address the vulnerabilities that became apparent during the COVID-19 pandemic, such as an over-reliance on outsourcing and offshoring. This may lead to a shift in the location where the final product is assembled, also known as “semi knock-down”. Parts are sourced to regular suppliers but are carried in higher density (i.e. they are not packaged) to a new assembly point closer to markets. Additional automation levels in manufacturing and material handling are also to be expected, reducing labour inputs, and improving flexibility in terms of location.

- Investments in transport infrastructure to expand the capacity, performance, and resilience of supply chains, including ports. Disruptions tend to underline the critical bottlenecks of a transportation system, often providing a renewed focus on improvements and investments.